us tax court calendar

Related Articles: us tax court calendar

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to us tax court calendar. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the U.S. Tax Court Calendar: A Comprehensive Guide

The United States Tax Court (USTC) is a specialized federal court responsible for resolving disputes between taxpayers and the Internal Revenue Service (IRS) regarding federal tax liabilities. Understanding the USTC calendar, its intricacies, and its significance is crucial for taxpayers seeking to navigate the complexities of tax litigation.

Understanding the U.S. Tax Court Calendar

The USTC calendar outlines the court’s schedule for hearings, trials, and other proceedings. It serves as a critical tool for both taxpayers and the IRS, ensuring a structured and efficient process for resolving tax disputes.

Key Features of the USTC Calendar:

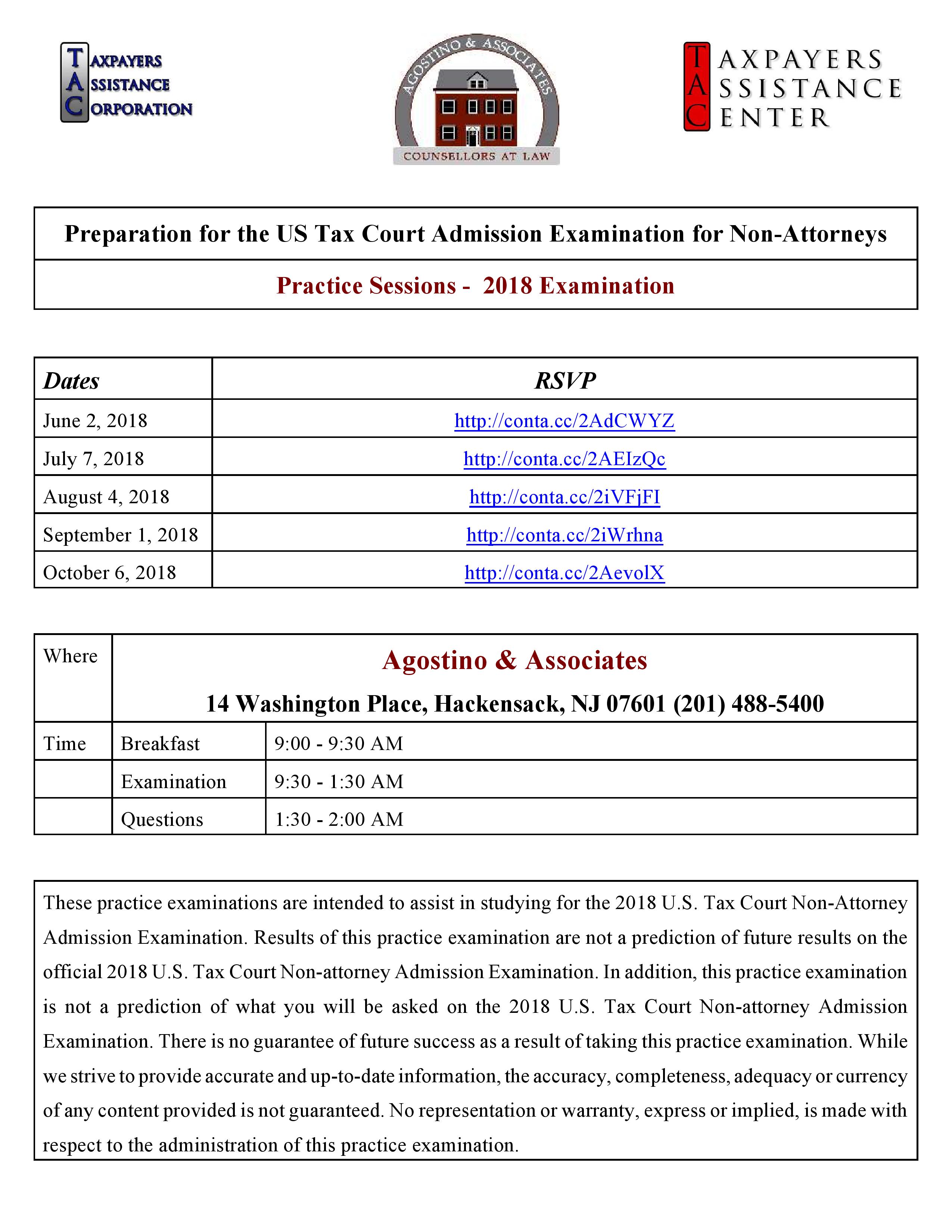

- Calendar Types: The USTC calendar is typically presented in two formats: a general calendar and a case-specific calendar. The general calendar provides an overview of the court’s schedule for all proceedings, while the case-specific calendar outlines the specific dates and deadlines for a particular case.

- Case Management: The calendar plays a crucial role in case management, ensuring timely completion of procedural steps, such as filing briefs, responding to motions, and scheduling hearings.

- Scheduling Hearings: The calendar is essential for scheduling hearings, including trial dates, pre-trial conferences, and settlement conferences.

- Deadlines and Notices: The calendar provides important information on deadlines for filing documents, responding to notices, and other procedural requirements.

- Public Access: The USTC calendar is typically available to the public online, allowing taxpayers and their representatives to access information about upcoming proceedings and deadlines.

The Importance of the USTC Calendar:

- Transparency and Fairness: The USTC calendar promotes transparency and fairness by providing a clear framework for the litigation process.

- Effective Case Management: The calendar enables the court to effectively manage cases, ensuring that deadlines are met and proceedings are conducted in a timely manner.

- Streamlined Process: The calendar streamlines the litigation process by providing a structured schedule for hearings, trials, and other procedural steps.

- Access to Information: The public availability of the calendar allows taxpayers and their representatives to stay informed about upcoming proceedings and deadlines.

- Predictability and Planning: The calendar provides predictability and allows taxpayers and their representatives to plan their litigation strategy effectively.

Navigating the USTC Calendar: A Practical Guide

- Case Number: The first step in accessing the USTC calendar is to identify the case number. This number is unique to each case and can be found on court documents.

- Online Calendar Access: The USTC calendar is typically available online on the court’s website. Users can search for specific cases or browse the general calendar for upcoming proceedings.

- Case-Specific Calendar: Once a case number is known, users can access the case-specific calendar, which provides detailed information on deadlines and scheduled events.

- Email Notifications: The USTC offers email notification services to alert users about changes or updates to the calendar.

- Contacting the Court: If users have difficulty accessing the calendar or have specific questions, they can contact the court directly for assistance.

Frequently Asked Questions (FAQs) about the U.S. Tax Court Calendar

Q: How can I access the U.S. Tax Court calendar?

A: The USTC calendar is typically accessible on the court’s official website. You can search for specific cases or browse the general calendar for upcoming proceedings.

Q: What information is included in the USTC calendar?

A: The USTC calendar outlines the court’s schedule for hearings, trials, and other proceedings, including specific dates, deadlines, and notices.

Q: How often is the USTC calendar updated?

A: The USTC calendar is regularly updated to reflect changes in scheduling and deadlines. It is advisable to check the calendar frequently for the most current information.

Q: What happens if I miss a deadline listed on the USTC calendar?

A: Missing a deadline listed on the USTC calendar can have serious consequences, including dismissal of the case or the imposition of sanctions. It is crucial to stay informed about all deadlines and to seek legal advice if you are unable to meet them.

Q: Can I request a change to the USTC calendar?

A: Requests for changes to the USTC calendar should be made in writing to the court and must be supported by compelling reasons. The court will consider the request and may grant or deny it based on the specific circumstances.

Tips for Using the USTC Calendar Effectively

- Stay Organized: Maintain a calendar or a system to track deadlines and important dates related to your case.

- Set Reminders: Use electronic reminders or calendar applications to ensure you don’t miss deadlines.

- Communicate with Your Representative: Regularly communicate with your legal representative to stay informed about changes in the USTC calendar and to discuss any scheduling conflicts.

- Review the Calendar Regularly: It is essential to review the USTC calendar frequently for updates and changes to deadlines or proceedings.

- Seek Legal Advice: If you have any questions or concerns about the USTC calendar or your case, consult with a qualified tax attorney or legal professional.

Conclusion

The U.S. Tax Court calendar is a vital tool for navigating the complexities of tax litigation. Understanding its features, importance, and practical applications empowers taxpayers to effectively manage their cases, ensure compliance with deadlines, and ultimately increase their chances of a favorable outcome. By utilizing the calendar effectively and seeking legal advice when needed, taxpayers can navigate the USTC process with confidence and clarity.

Closure

Thus, we hope this article has provided valuable insights into us tax court calendar. We thank you for taking the time to read this article. See you in our next article!