Understanding the HHS 2025 Payroll Calendar: A Guide for Healthcare Providers

Related Articles: Understanding the HHS 2025 Payroll Calendar: A Guide for Healthcare Providers

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Understanding the HHS 2025 Payroll Calendar: A Guide for Healthcare Providers. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding the HHS 2025 Payroll Calendar: A Guide for Healthcare Providers

The healthcare industry is a complex landscape, navigating intricate regulations and evolving payment models. Among the many challenges, accurately managing payroll and adhering to stringent compliance requirements stands out. To streamline this process and ensure timely payments, the Department of Health and Human Services (HHS) has implemented a comprehensive payroll calendar for 2025. This calendar serves as a vital tool for healthcare providers, offering clarity and predictability in their financial operations.

The Importance of a Comprehensive Payroll Calendar

A well-structured payroll calendar is not simply a list of dates. It is a strategic document that facilitates:

- Accurate Payment Processing: The calendar clearly outlines payment cycles, deadlines, and any potential adjustments, minimizing the risk of late payments and associated penalties.

- Improved Cash Flow Management: By understanding the timing of payments, healthcare providers can better forecast their revenue and expenses, leading to enhanced financial planning and stability.

- Enhanced Compliance: The HHS 2025 payroll calendar aligns with federal and state regulations, ensuring that healthcare providers meet all legal requirements and avoid potential fines or sanctions.

- Reduced Administrative Burden: The calendar eliminates the need for constant manual tracking of payment dates, freeing up valuable time and resources for healthcare providers to focus on patient care.

Key Features of the HHS 2025 Payroll Calendar

The HHS 2025 payroll calendar encompasses several key features:

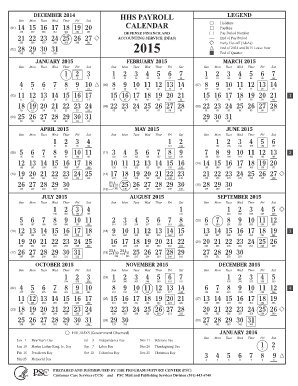

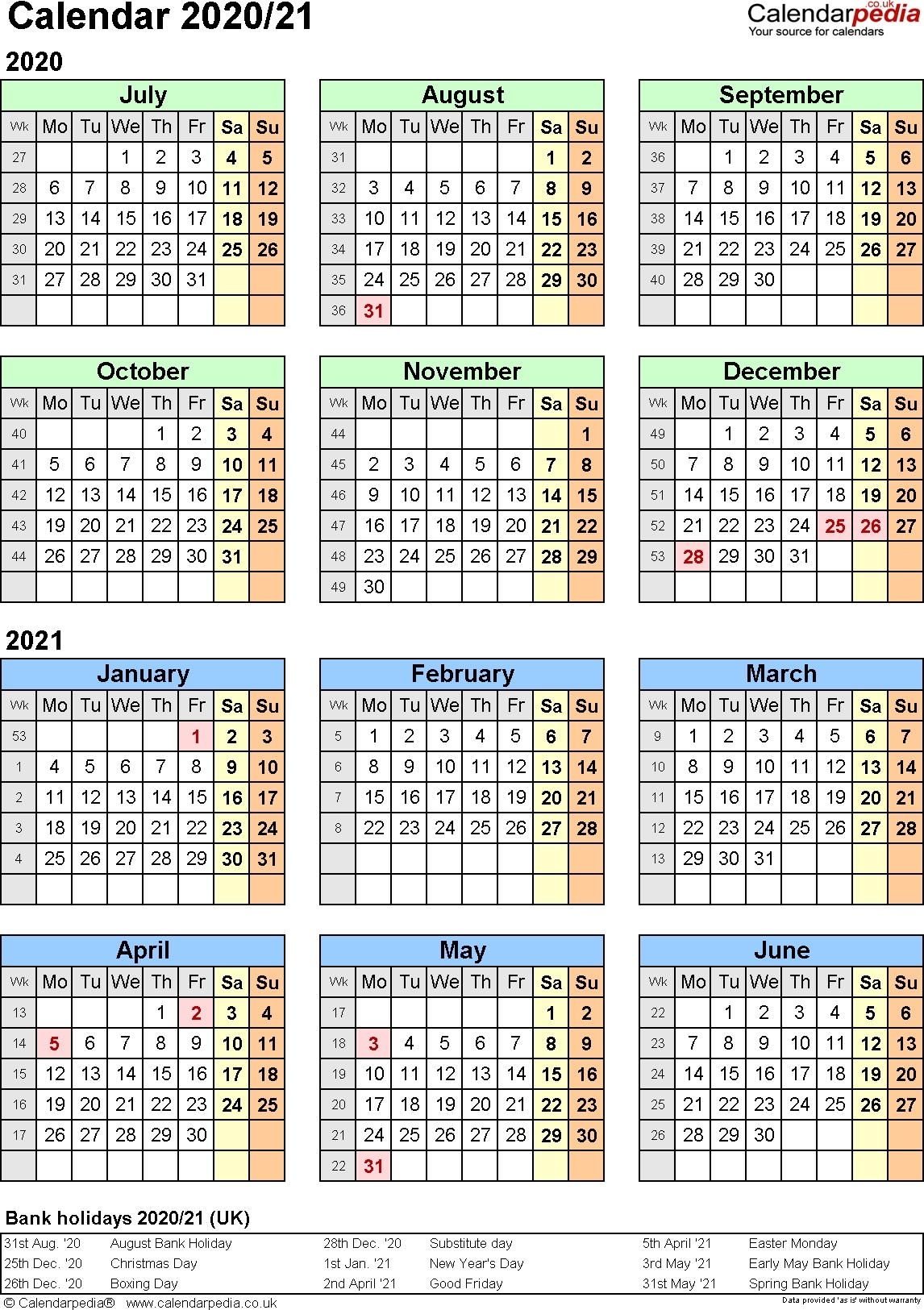

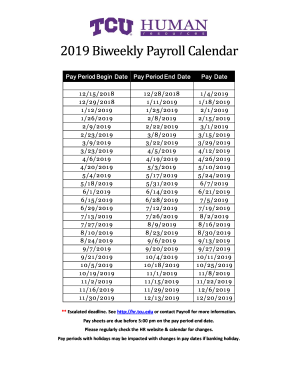

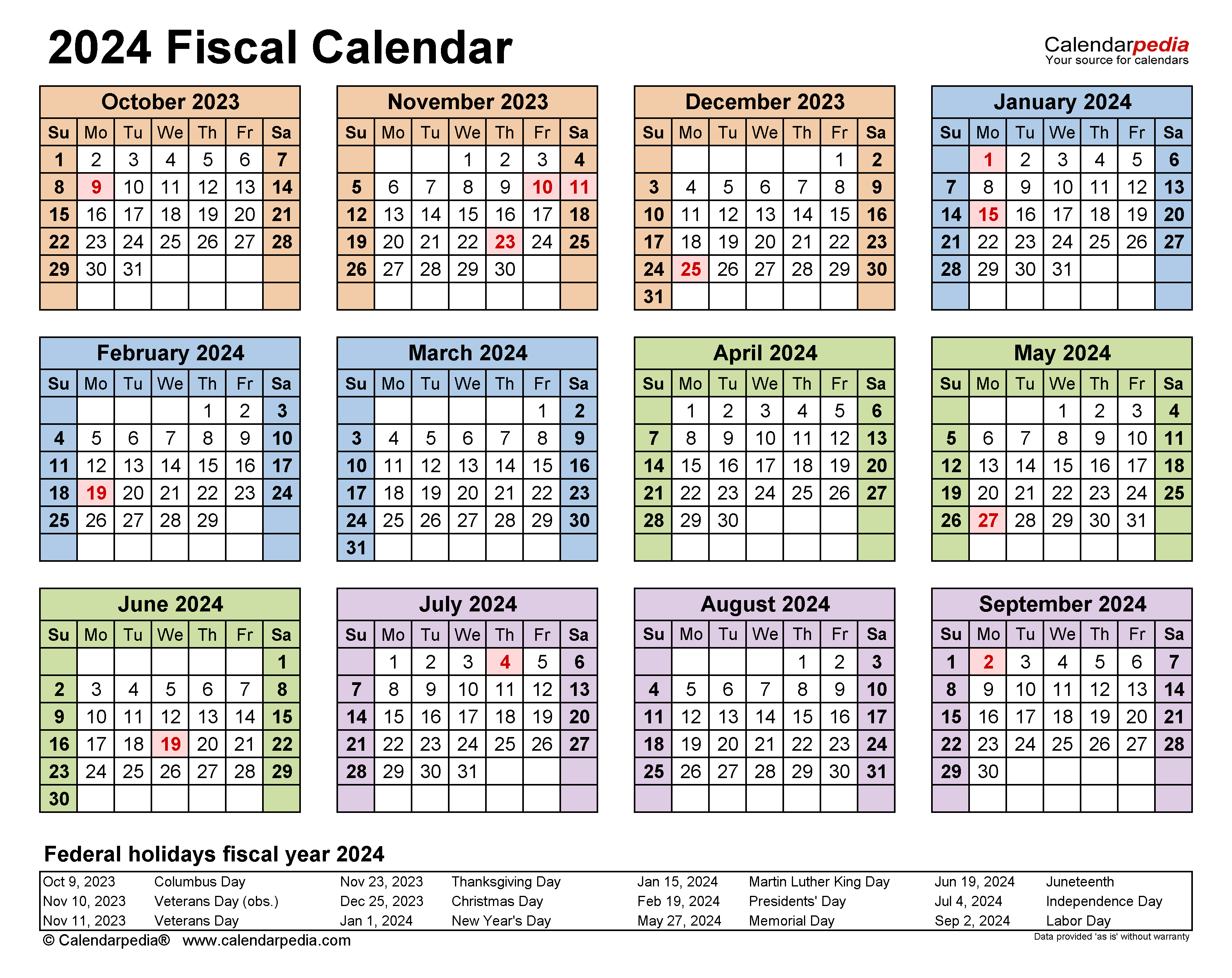

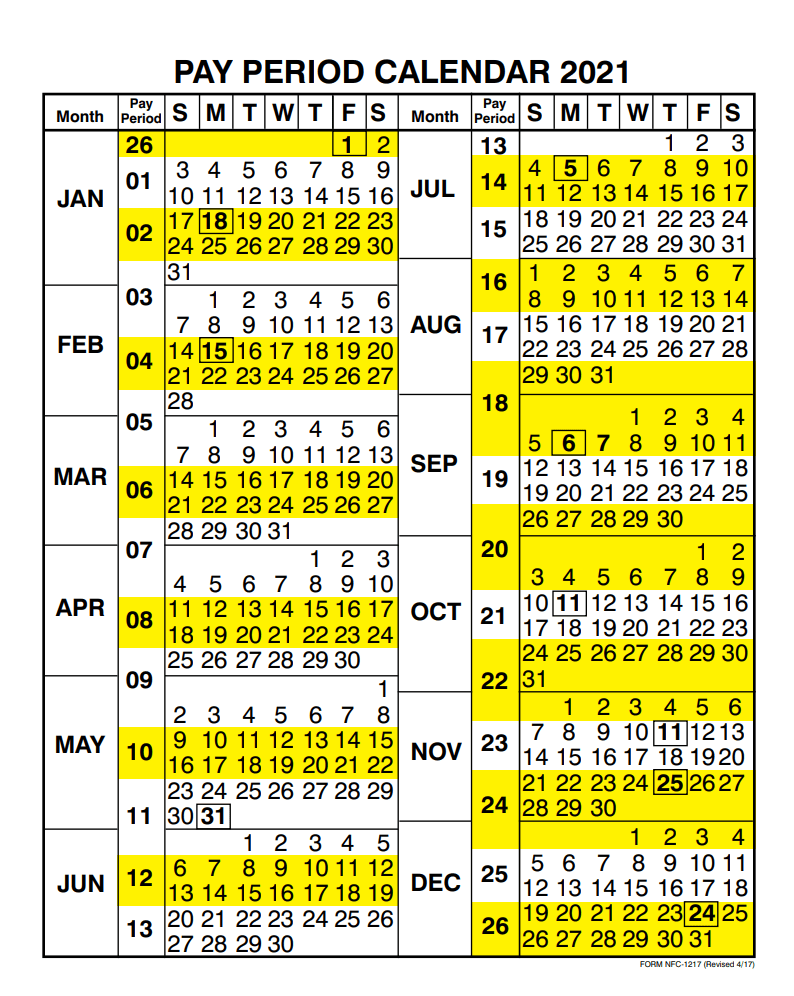

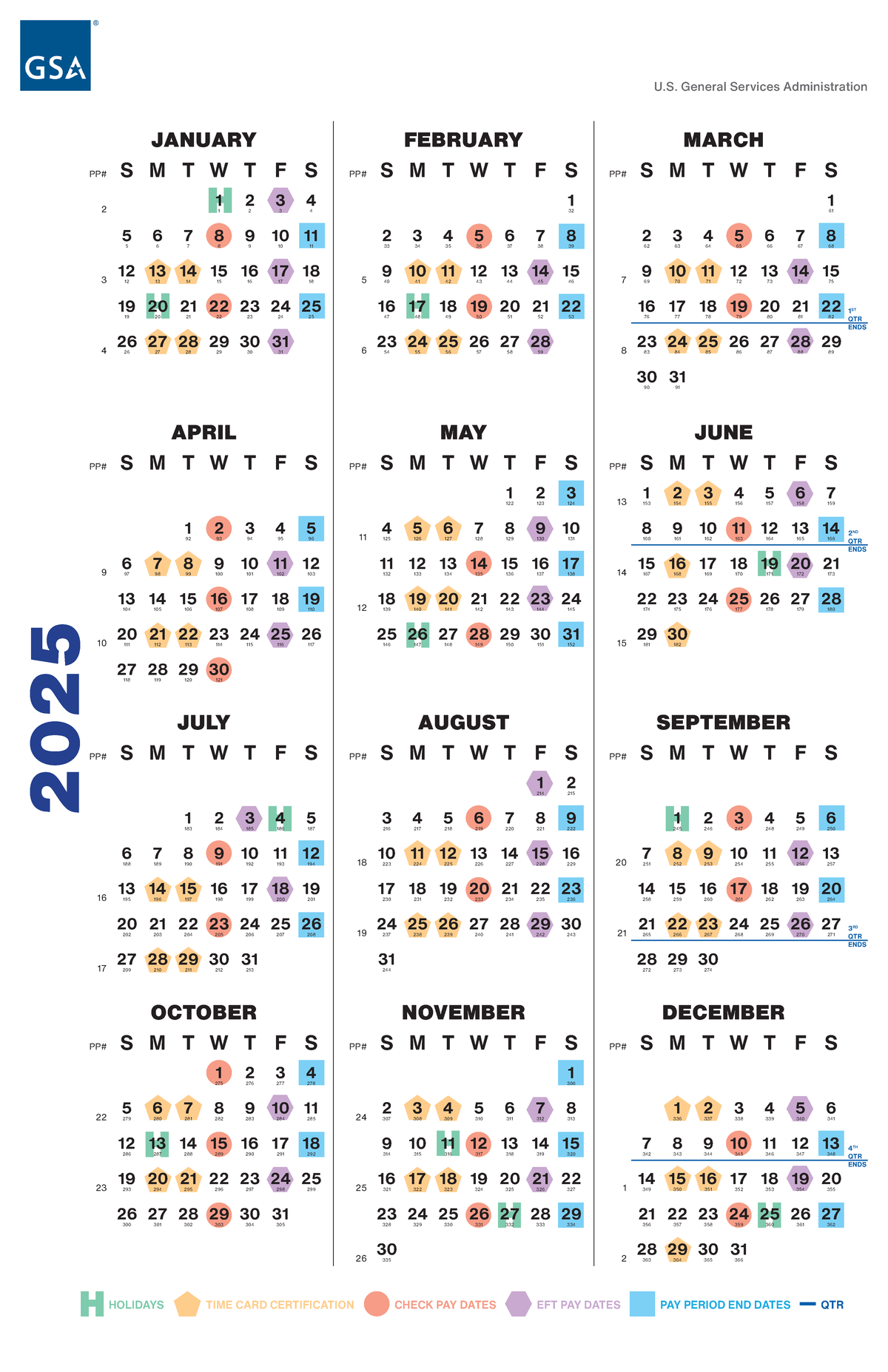

- Payment Cycles: The calendar specifies the regular payment cycles throughout the year, including bi-weekly, semi-monthly, or monthly schedules.

- Payment Deadlines: It details the specific dates by which healthcare providers must submit their claims to receive payment.

- Holidays and Adjustments: The calendar incorporates federal holidays and any potential adjustments to payment schedules due to unforeseen circumstances.

- Electronic Funds Transfer (EFT) Information: It provides details on the preferred method of payment, including bank account information for electronic transfers.

- Contact Information: The calendar includes relevant contact information for the HHS office responsible for payroll processing and inquiries.

Navigating the HHS 2025 Payroll Calendar

Healthcare providers can effectively navigate the HHS 2025 payroll calendar by:

- Reviewing the Calendar Regularly: Familiarize yourself with the key dates and payment cycles to avoid any surprises or missed deadlines.

- Utilizing the Calendar for Financial Planning: Incorporate the calendar’s information into your budget projections and cash flow forecasts.

- Maintaining Accurate Records: Keep detailed records of all submitted claims and received payments to ensure proper reconciliation.

- Seeking Clarification When Needed: If you have any questions or uncertainties regarding the calendar, contact the HHS office for assistance.

FAQs Regarding the HHS 2025 Payroll Calendar

1. What are the payment cycles outlined in the HHS 2025 payroll calendar?

The calendar specifies the payment cycles for different types of claims. Some claims may be processed bi-weekly, while others may be paid semi-monthly or monthly.

2. How can I access the HHS 2025 payroll calendar?

The calendar is typically available on the HHS website or through designated channels for healthcare providers.

3. What are the consequences of missing a payment deadline?

Missing a payment deadline can result in delayed payments, potential penalties, and even suspension of future payments.

4. What are the common adjustments to the payment schedule?

Adjustments to the payment schedule can occur due to federal holidays, natural disasters, or other unforeseen events.

5. How can I update my bank account information for electronic funds transfer?

The HHS website or designated contact information will provide details on how to update your bank account information for EFT.

Tips for Utilizing the HHS 2025 Payroll Calendar

- Automate Payment Reminders: Use software or calendar applications to set reminders for payment deadlines and ensure timely submission of claims.

- Establish a Dedicated Team: Designate a team or individual responsible for managing payroll processes and adhering to the calendar’s guidelines.

- Invest in Training: Provide your staff with training on the HHS 2025 payroll calendar and its implications for their work.

- Monitor Payment Trends: Regularly analyze payment patterns and any potential delays to identify areas for improvement.

- Stay Updated on Changes: The HHS may update the payroll calendar from time to time. Stay informed about any modifications to ensure compliance.

Conclusion

The HHS 2025 payroll calendar is an invaluable resource for healthcare providers, offering clarity, predictability, and improved financial management. By understanding its features and utilizing its information effectively, healthcare providers can streamline their payroll processes, enhance their financial stability, and ensure compliance with regulatory requirements. By adhering to the calendar’s guidelines and proactively addressing any questions or concerns, healthcare providers can navigate the complex world of healthcare payments with confidence and efficiency.

Closure

Thus, we hope this article has provided valuable insights into Understanding the HHS 2025 Payroll Calendar: A Guide for Healthcare Providers. We hope you find this article informative and beneficial. See you in our next article!