Understanding Social Security Payments in 2025: A Comprehensive Guide

Related Articles: Understanding Social Security Payments in 2025: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Understanding Social Security Payments in 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Understanding Social Security Payments in 2025: A Comprehensive Guide

- 2 Introduction

- 3 Understanding Social Security Payments in 2025: A Comprehensive Guide

- 3.1 The Importance of a Social Security Payment Calendar

- 3.2 Understanding the 2025 Social Security Payment Schedule

- 3.3 Potential Adjustments to Social Security Payments in 2025

- 3.4 Strategies for Maximizing Social Security Benefits in 2025

- 3.5 Frequently Asked Questions (FAQs) about Social Security Payments in 2025

- 3.6 Tips for Managing Social Security Payments in 2025

- 3.7 Conclusion

- 4 Closure

Understanding Social Security Payments in 2025: A Comprehensive Guide

Social Security, a vital lifeline for millions of Americans, provides financial security during retirement, disability, and other challenging life circumstances. As we approach 2025, understanding how Social Security payments will be structured and how they may impact individuals becomes increasingly crucial. This comprehensive guide aims to provide clarity on the intricacies of Social Security payments in 2025, addressing key aspects such as payment schedules, potential adjustments, and strategies for maximizing benefits.

The Importance of a Social Security Payment Calendar

A Social Security payment calendar serves as a vital tool for beneficiaries, offering a predictable schedule for receiving their monthly benefits. This predictability is essential for budgeting, planning, and ensuring financial stability. The calendar helps individuals:

- Plan for essential expenses: Knowing the exact dates of payments allows for precise budgeting, ensuring that essential needs are met throughout the month.

- Avoid financial surprises: A fixed payment schedule eliminates uncertainty, preventing unexpected financial gaps and ensuring a consistent flow of income.

- Manage debt and savings: With a clear understanding of when payments arrive, beneficiaries can effectively manage debt repayments, allocate funds for savings, and make informed financial decisions.

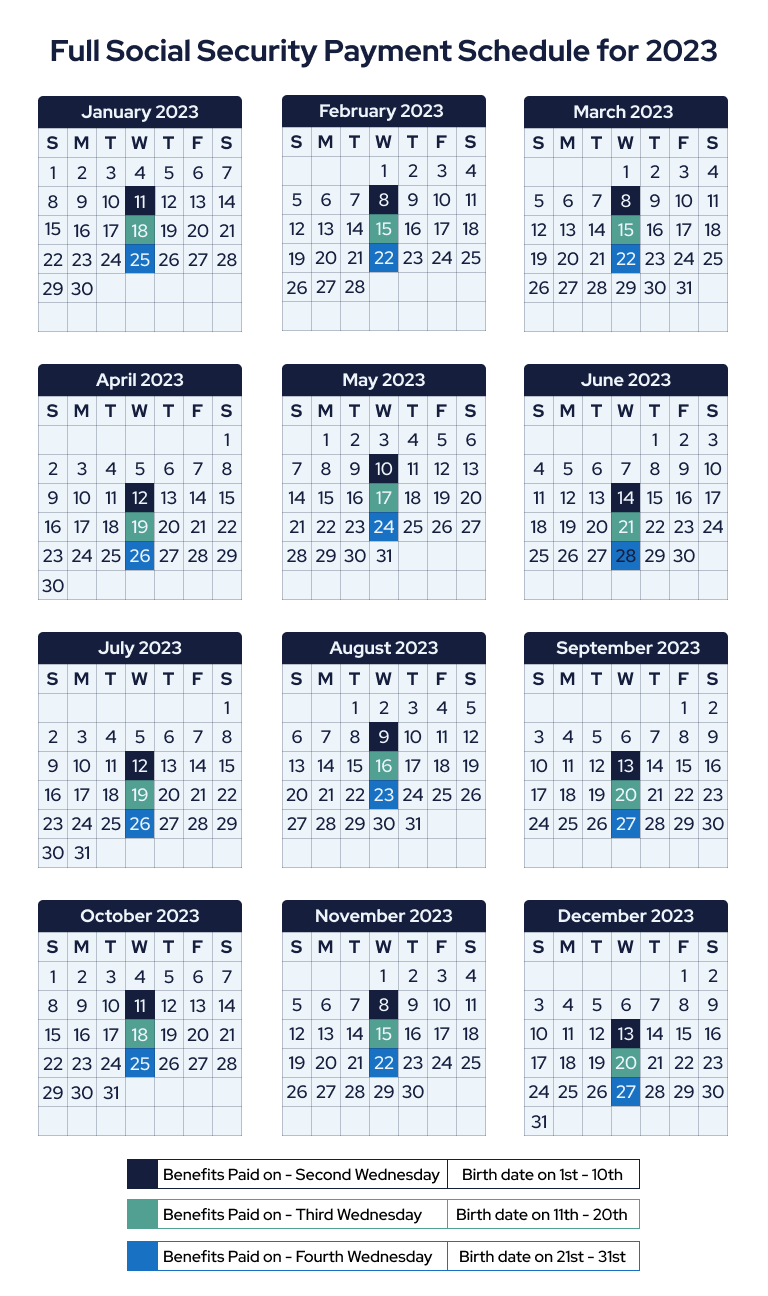

Understanding the 2025 Social Security Payment Schedule

While the exact dates for 2025 payments are not yet finalized, a general understanding of the payment schedule can be gleaned from historical data and current trends. Typically, Social Security payments are issued on the second, third, and fourth Wednesdays of each month. The specific date depends on the beneficiary’s birthdate:

- Second Wednesday: Individuals born between the 1st and 10th of a month receive their payment on the second Wednesday.

- Third Wednesday: Those born between the 11th and 20th receive their payment on the third Wednesday.

- Fourth Wednesday: Individuals born between the 21st and 31st receive their payment on the fourth Wednesday.

Note: There are exceptions to this general rule. If the second, third, or fourth Wednesday falls on a federal holiday, the payment will be issued on the preceding business day.

Potential Adjustments to Social Security Payments in 2025

Several factors can influence Social Security payments in 2025, impacting the amount beneficiaries receive. These include:

- Cost of Living Adjustment (COLA): The Social Security Administration (SSA) annually adjusts benefits based on inflation, ensuring that the purchasing power of payments remains consistent. The COLA for 2025 is yet to be determined, but it will be calculated using the Consumer Price Index (CPI) for Urban Wage Earners and Clerical Workers (CPI-W) for the third quarter of 2024.

- Changes in eligibility requirements: The SSA may adjust eligibility requirements for various Social Security programs, such as retirement benefits, disability benefits, and survivor benefits. These changes could impact the number of individuals eligible for benefits and the amount they receive.

- Legislative changes: Congress may enact new laws affecting Social Security, potentially altering payment schedules, benefit amounts, or eligibility criteria. Keeping abreast of any legislative developments is crucial for beneficiaries.

Strategies for Maximizing Social Security Benefits in 2025

Individuals can take proactive steps to maximize their Social Security benefits:

- Delaying retirement: Waiting to claim benefits beyond the full retirement age (FRA) results in a higher monthly payment. For those born in 1960 or later, the FRA is 67 years old.

- Working longer: Continued employment beyond the FRA can increase your benefit amount. Earnings beyond the FRA do not affect benefits, but can increase the amount you receive.

- Planning for potential changes: Stay informed about potential adjustments to Social Security payments and eligibility requirements. This knowledge allows for effective financial planning and adaptation.

Frequently Asked Questions (FAQs) about Social Security Payments in 2025

1. How can I find the exact payment dates for my Social Security benefits in 2025?

The SSA typically publishes a yearly payment calendar in advance. You can access this calendar on the SSA website or contact your local Social Security office for the most up-to-date information.

2. Will my Social Security payments increase in 2025?

The COLA for 2025 will be determined based on the inflation rate during the third quarter of 2024. If inflation remains high, a significant COLA increase is possible. However, the actual amount will be announced closer to the end of 2024.

3. What happens if my Social Security payment date falls on a holiday?

If the scheduled payment date falls on a federal holiday, the payment will be issued on the preceding business day. The SSA will notify beneficiaries of any such adjustments.

4. Can I change the date I receive my Social Security payments?

Generally, Social Security payments are issued on a fixed schedule based on the beneficiary’s birthdate. However, there are some exceptions, such as individuals who are receiving benefits through a direct deposit account. Contact the SSA to inquire about any possible options for altering your payment schedule.

5. How can I ensure I receive my Social Security payments on time?

The most reliable way to receive payments on time is through direct deposit. This method eliminates potential delays associated with mail delivery. Contact the SSA to set up direct deposit if you haven’t already.

6. What resources are available if I have questions about my Social Security benefits?

The SSA offers a wealth of resources to help beneficiaries understand their benefits. You can visit the SSA website, call the SSA hotline, or contact your local Social Security office.

7. Can I receive Social Security benefits if I am still working?

Yes, you can receive Social Security benefits while working, but your earnings may affect the amount of benefits you receive. The SSA provides guidelines on how earnings affect benefits, which can be found on their website.

8. What happens to my Social Security benefits if I die?

Upon your death, your surviving spouse or dependents may be eligible for survivor benefits. The SSA provides information about survivor benefits on their website.

Tips for Managing Social Security Payments in 2025

- Review your payment information: Ensure your contact information and banking details are up to date with the SSA to avoid any delays in receiving payments.

- Plan for potential adjustments: Stay informed about any changes to Social Security payments and adjust your budget accordingly.

- Maximize your benefits: Explore strategies for increasing your benefits, such as delaying retirement or working longer.

- Seek professional advice: Consult with a financial advisor or tax professional for personalized guidance on managing your Social Security benefits.

Conclusion

Social Security payments play a vital role in the financial well-being of millions of Americans. Understanding the payment schedule, potential adjustments, and strategies for maximizing benefits is crucial for ensuring financial stability and security. By staying informed, planning effectively, and taking proactive steps, individuals can navigate the complexities of Social Security and secure their financial future.

This guide has provided a comprehensive overview of Social Security payments in 2025. Remember, the information provided is for general knowledge and should not be considered legal or financial advice. Consult with the SSA or a qualified professional for personalized guidance. As the landscape of Social Security continues to evolve, staying informed and proactive is essential for maximizing your benefits and securing your financial future.

Closure

Thus, we hope this article has provided valuable insights into Understanding Social Security Payments in 2025: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!