Navigating the IRS Refund Calendar: A Comprehensive Guide

Related Articles: Navigating the IRS Refund Calendar: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the IRS Refund Calendar: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the IRS Refund Calendar: A Comprehensive Guide

The Internal Revenue Service (IRS) refund calendar, though not a concrete schedule, provides valuable insight into the general timeframe for receiving tax refunds. Understanding this calendar can help taxpayers anticipate the arrival of their refund and manage their financial planning accordingly.

The Dynamics of the IRS Refund Calendar

The IRS refund calendar is not a fixed schedule with specific dates for each individual taxpayer. It is a general estimate based on the volume of tax returns processed and the efficiency of the IRS system. Several factors influence the processing time, including:

- Filing Method: Electronic filing through e-file is significantly faster than paper filing, often resulting in quicker refund processing.

- Tax Return Complexity: Simple tax returns with straightforward deductions and credits are processed faster than complex returns with multiple deductions, credits, and adjustments.

- Errors and Omissions: Errors or missing information on tax returns can lead to delays as the IRS needs to verify the information and potentially request additional documentation.

- Verification and Audits: The IRS may select certain tax returns for verification or audit, delaying the refund processing time.

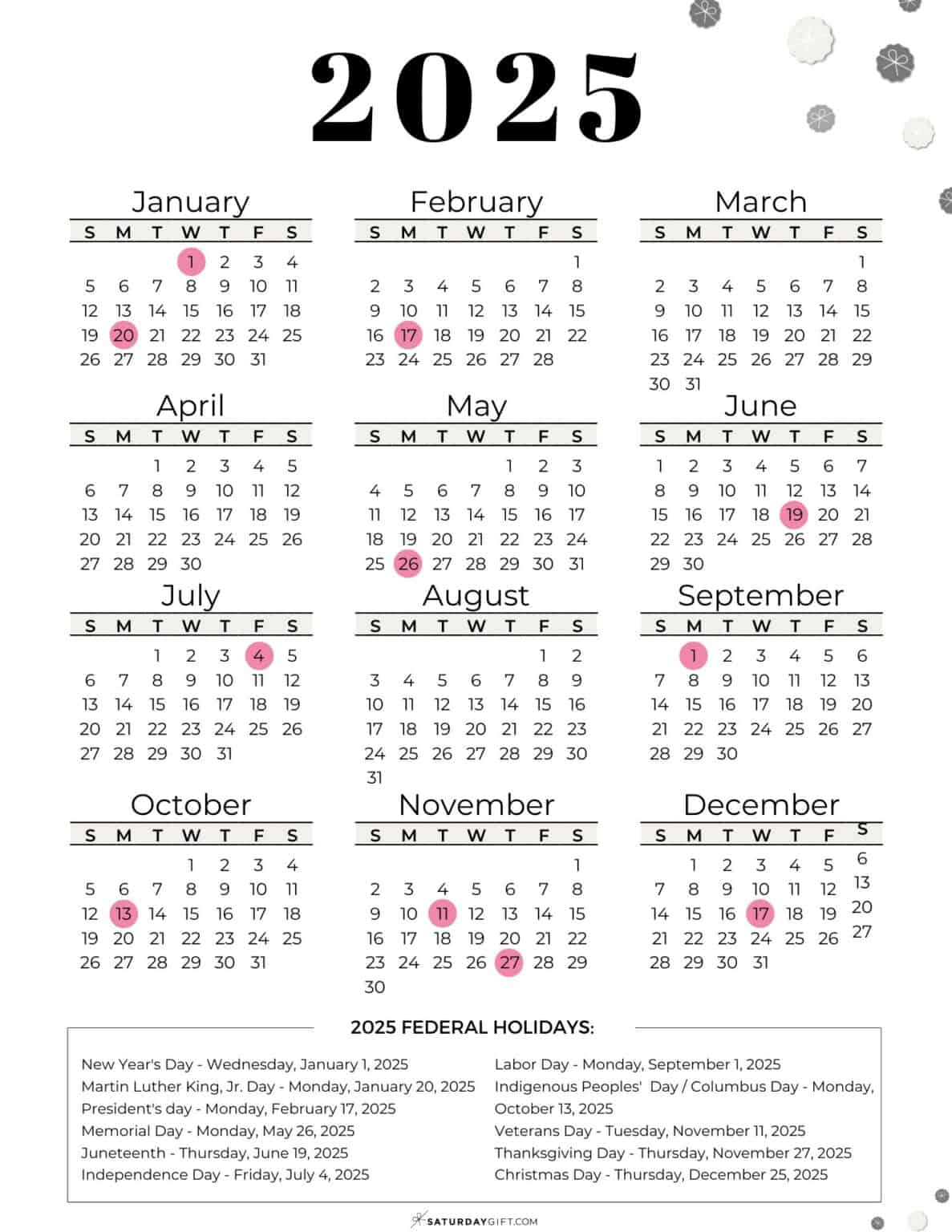

- IRS Workload: The IRS’s workload fluctuates throughout the year, with the busiest periods during the tax season. This can impact the processing time for individual tax returns.

Understanding the Estimated Timeframe

While the IRS refund calendar does not offer specific dates, it provides a general estimate of processing times based on historical data. Generally, taxpayers who file electronically and have simple tax returns can expect to receive their refunds within 21 days of filing. However, this timeframe can vary depending on the factors mentioned above.

Utilizing the IRS Refund Calendar for Financial Planning

The IRS refund calendar can be a useful tool for financial planning. By understanding the general timeframe for refund processing, taxpayers can:

- Budget Accordingly: Knowing the potential arrival date of a refund can help individuals plan their finances and allocate funds for various expenses.

- Anticipate Cash Flow: Individuals expecting a refund can factor it into their financial projections, allowing them to make informed decisions regarding spending and saving.

- Minimize Financial Stress: By understanding the refund processing timeline, taxpayers can avoid unnecessary financial stress and prepare for potential delays.

Accessing the IRS Refund Calendar

The IRS does not publish a specific refund calendar with exact dates. However, the IRS website provides valuable information regarding tax refund processing times and related resources. You can access this information on the IRS website: [Insert Link to IRS Website].

Frequently Asked Questions (FAQs) Regarding the IRS Refund Calendar

1. How can I track the status of my tax refund?

You can track the status of your tax refund using the IRS’s "Where’s My Refund?" tool available on the IRS website. This tool allows you to check the status of your refund using your Social Security number, filing status, and the exact amount of the refund claimed on your tax return.

2. Why is my tax refund taking longer than expected?

There are various reasons why your refund might take longer than expected. These include:

- Errors or omissions on your tax return: The IRS may need to verify information or request additional documentation if your return contains errors or omissions.

- Verification or audit: The IRS may select certain tax returns for verification or audit, which can delay the processing time.

- IRS workload: The IRS’s workload fluctuates throughout the year, impacting the processing time for individual tax returns.

3. Can I expedite the processing of my tax refund?

While there is no guaranteed way to expedite the processing of your tax refund, you can take the following steps to ensure a smooth and timely process:

- File electronically: E-filing is significantly faster than paper filing.

- Double-check your return: Ensure accuracy and completeness before submitting your tax return.

- Provide accurate contact information: Ensure the IRS has your current address and phone number.

4. What happens if I owe the IRS taxes?

If you owe the IRS taxes, you will receive a notice indicating the amount owed and the due date for payment. You can pay your taxes online, by phone, or by mail. Failure to pay taxes by the due date can result in penalties and interest charges.

5. What are the consequences of filing a fraudulent tax return?

Filing a fraudulent tax return is a serious offense with severe consequences, including:

- Criminal penalties: Fraudulent tax returns can lead to criminal charges, including fines and imprisonment.

- Civil penalties: The IRS can impose civil penalties for fraudulent tax returns, including back taxes, interest, and penalties.

- Reputational damage: A conviction for tax fraud can damage your reputation and make it difficult to secure loans or employment.

Tips for Navigating the IRS Refund Calendar

- File electronically: E-filing is the fastest and most efficient way to file your taxes, leading to faster refund processing.

- File early: Filing your taxes early can help you avoid delays caused by the IRS’s increased workload during peak tax season.

- Double-check your return: Ensure accuracy and completeness before submitting your tax return to minimize the risk of errors and delays.

- Use the "Where’s My Refund?" tool: This tool allows you to track the status of your refund and stay informed about its processing.

- Contact the IRS if you have questions: If you have any questions or concerns regarding your tax refund, contact the IRS for assistance.

Conclusion

The IRS refund calendar is a valuable resource for taxpayers, providing general estimates for processing times and enabling informed financial planning. By understanding the factors influencing refund processing and utilizing the available resources, taxpayers can navigate the refund process efficiently and manage their finances effectively. Remember, accuracy, completeness, and timely filing are crucial for receiving your tax refund promptly.

Closure

Thus, we hope this article has provided valuable insights into Navigating the IRS Refund Calendar: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!