Navigating the Fiscal Year 2025 Pay Period Calendar: A Comprehensive Guide

Related Articles: Navigating the Fiscal Year 2025 Pay Period Calendar: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Fiscal Year 2025 Pay Period Calendar: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Fiscal Year 2025 Pay Period Calendar: A Comprehensive Guide

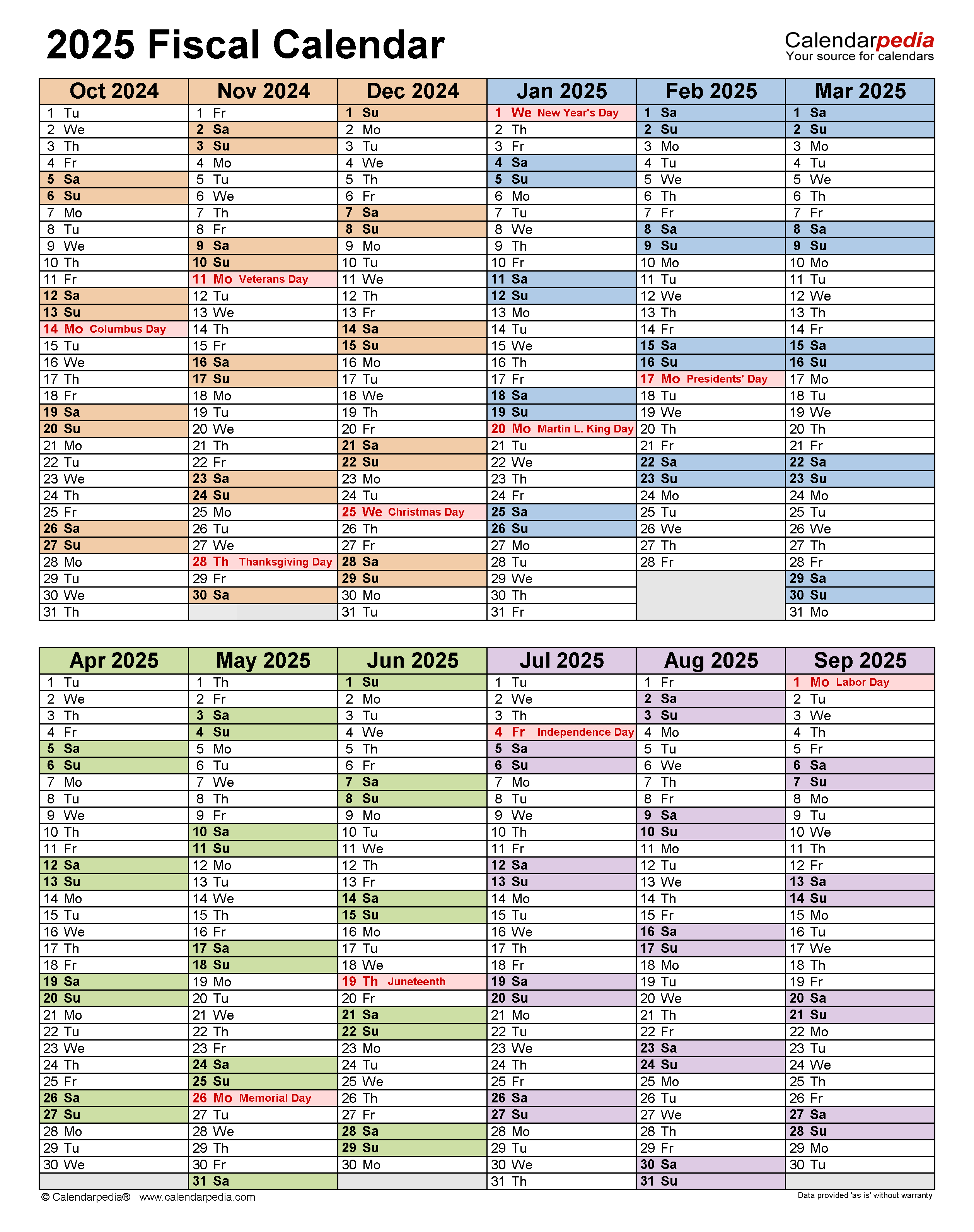

The Fiscal Year 2025 (FY25) pay period calendar serves as a vital tool for organizations and individuals alike, providing a structured framework for payroll processing, budgeting, and financial planning. Understanding its intricacies and nuances is crucial for ensuring accurate compensation and efficient financial management. This article aims to provide a comprehensive overview of the FY25 pay period calendar, highlighting its key features, significance, and practical applications.

Understanding the Fiscal Year and Pay Periods:

The fiscal year (FY) is a 12-month period used by governments and many organizations for accounting and budgeting purposes. It does not necessarily align with the calendar year (January to December). The United States federal government, for instance, operates on a fiscal year that runs from October 1st to September 30th.

Pay periods, on the other hand, are recurring intervals during which employee wages are calculated and distributed. These periods can be weekly, bi-weekly, semi-monthly, or monthly, depending on the organization’s payroll practices.

Key Features of the FY25 Pay Period Calendar:

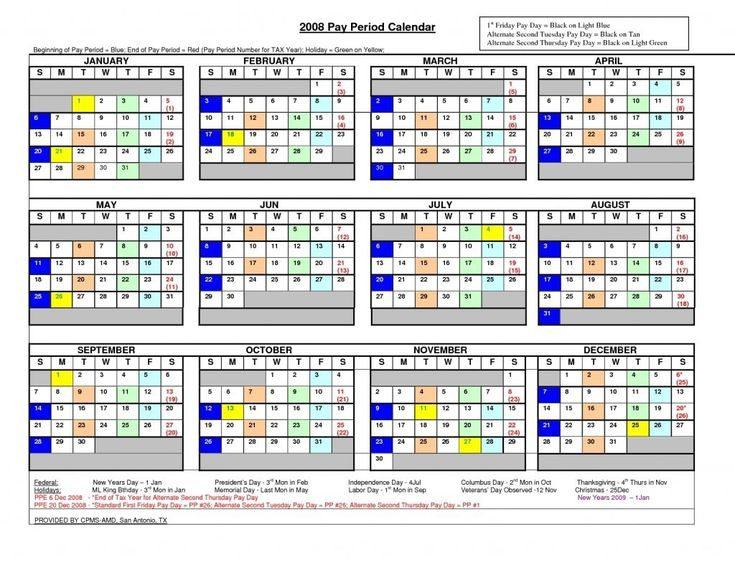

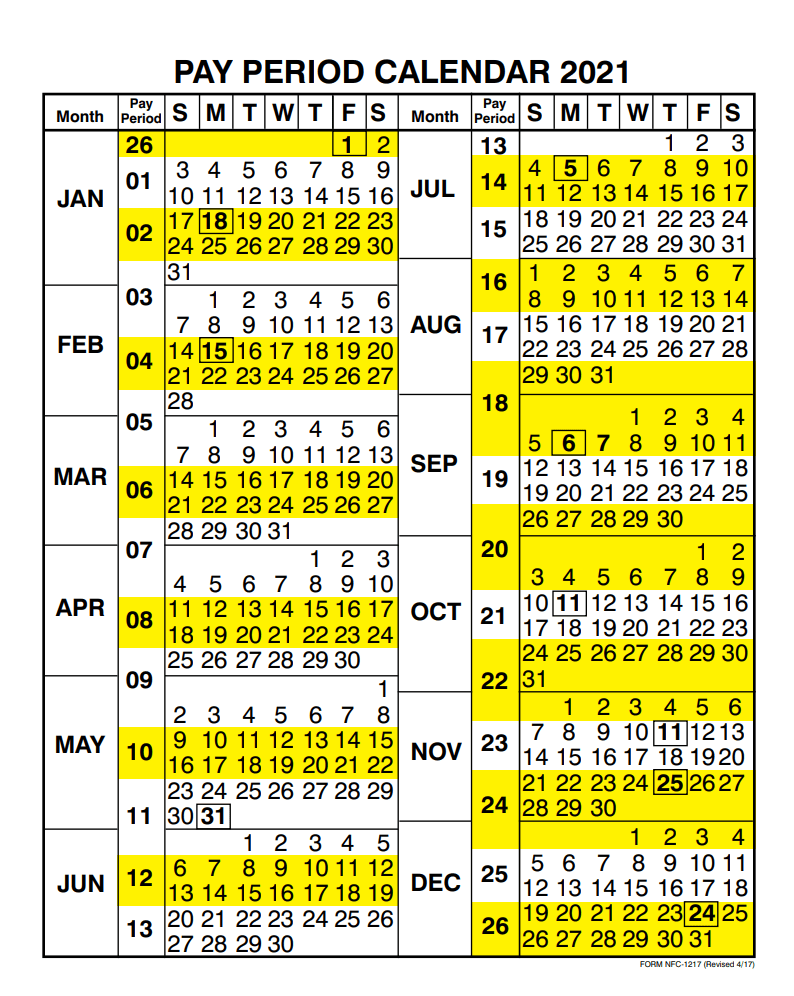

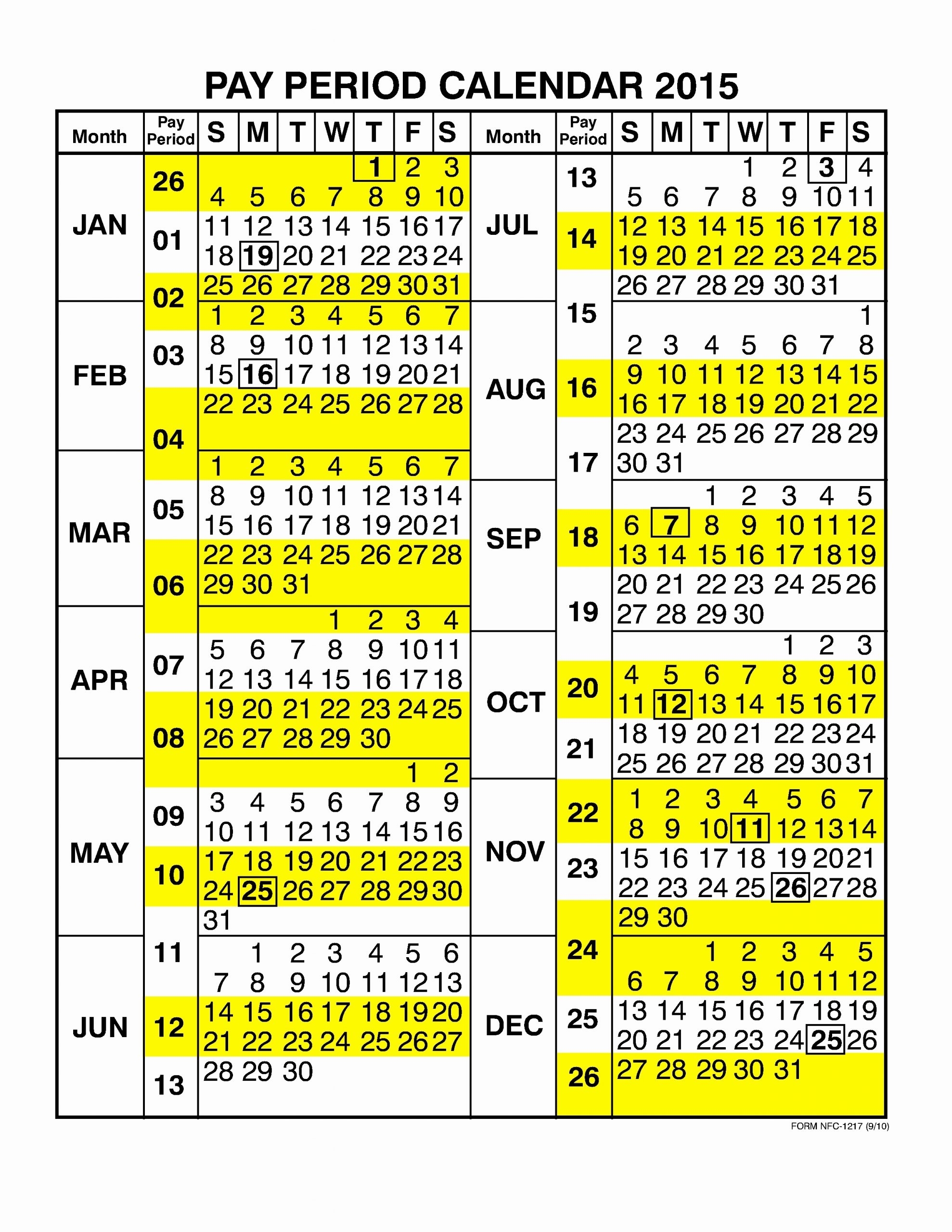

The FY25 pay period calendar outlines the specific dates for each pay period throughout the fiscal year. This calendar typically includes:

- Pay Period Start and End Dates: Each pay period is defined by its starting and ending dates, which determine the time frame for calculating employee earnings.

- Pay Dates: The calendar specifies the date on which employees are scheduled to receive their paychecks.

- Holidays and Weekends: The calendar accounts for federal holidays and weekends, which may impact pay period dates and payroll processing.

- Special Considerations: It may include details regarding payroll adjustments for specific events, such as year-end bonuses or tax withholdings.

Importance and Benefits of the FY25 Pay Period Calendar:

The FY25 pay period calendar plays a crucial role in various aspects of financial management:

- Payroll Accuracy: The calendar ensures timely and accurate payroll processing by providing a clear schedule for calculating and distributing wages.

- Budgeting and Forecasting: Organizations can use the calendar to predict payroll expenses and incorporate them into their budgeting and financial forecasting models.

- Employee Compensation: The calendar provides employees with a consistent and predictable pay schedule, fostering financial stability and planning.

- Compliance with Regulations: The calendar helps organizations comply with labor laws and regulations regarding wage payments and recordkeeping.

- Financial Planning: Individuals can utilize the calendar to plan their personal finances, track income, and manage expenses.

Navigating the Calendar: Practical Tips

- Accessibility: Ensure you have access to the official FY25 pay period calendar from your employer or relevant government website.

- Review and Understand: Carefully review the calendar to familiarize yourself with the pay dates and any special considerations.

- Mark Important Dates: Highlight key dates, such as pay dates, holidays, and deadlines for tax filings.

- Stay Informed: Be aware of any updates or changes to the calendar, as these may occur due to unforeseen circumstances.

- Utilize Resources: Consult with your payroll department or financial advisor for clarification on any aspects of the calendar.

Frequently Asked Questions (FAQs) regarding the FY25 Pay Period Calendar:

Q1: Where can I find the official FY25 pay period calendar?

A1: The specific location for the FY25 pay period calendar will depend on your organization or government agency. It may be accessible through your employer’s intranet, payroll portal, or the official website of the relevant government body.

Q2: What happens if a pay date falls on a weekend or holiday?

A2: In such cases, the pay date will typically be shifted to the next business day. The FY25 pay period calendar will usually specify the adjusted pay date for these situations.

Q3: How does the calendar impact my personal finances?

A3: The calendar helps you anticipate your income and plan your spending accordingly. By knowing your pay dates, you can manage your budget, schedule bill payments, and make informed financial decisions.

Q4: What are some common payroll deductions that are reflected in the calendar?

A4: Common payroll deductions include federal and state income taxes, Social Security and Medicare taxes, health insurance premiums, retirement contributions, and other deductions as specified by your employer.

Q5: Are there any legal implications related to the FY25 pay period calendar?

A5: Yes, organizations must comply with labor laws and regulations regarding wage payment frequency, overtime, and other payroll-related matters. The FY25 pay period calendar helps ensure compliance with these regulations.

Conclusion:

The FY25 pay period calendar is an essential tool for managing payroll, budgeting, and financial planning. By understanding its features, importance, and practical applications, individuals and organizations can ensure accurate compensation, efficient financial management, and adherence to relevant regulations. Utilizing the calendar effectively fosters financial stability, promotes transparency, and facilitates informed decision-making.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Fiscal Year 2025 Pay Period Calendar: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!