Navigating the Federal Tax Calendar: A Comprehensive Guide for Individuals and Businesses

Related Articles: Navigating the Federal Tax Calendar: A Comprehensive Guide for Individuals and Businesses

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Federal Tax Calendar: A Comprehensive Guide for Individuals and Businesses. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Federal Tax Calendar: A Comprehensive Guide for Individuals and Businesses

The federal tax calendar, a complex tapestry of deadlines and requirements, plays a crucial role in the financial life of individuals and businesses alike. Understanding this calendar is paramount for ensuring compliance with tax laws and optimizing financial outcomes. This comprehensive guide delves into the intricacies of the federal tax calendar, providing a clear roadmap for navigating its complexities.

Understanding the Fundamentals

The federal tax calendar is established by the Internal Revenue Service (IRS), the agency responsible for administering and enforcing federal tax laws in the United States. It outlines key dates for filing tax returns, making payments, and fulfilling other tax-related obligations.

Key Dates and Deadlines

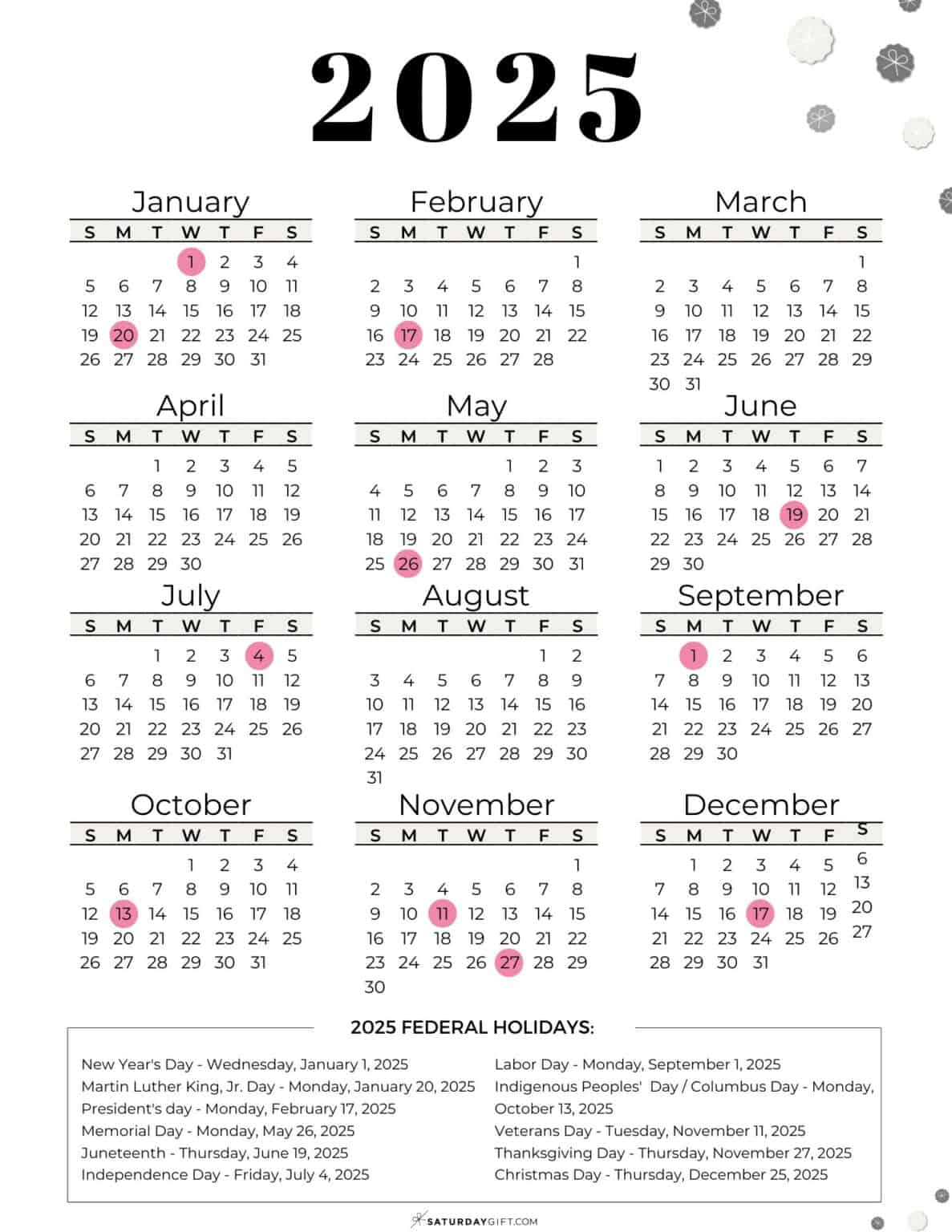

The federal tax calendar is anchored by a series of critical deadlines:

- Tax Filing Season: The IRS typically opens the tax filing season in late January or early February, allowing taxpayers to file their returns for the previous calendar year.

- Tax Filing Deadline: The traditional tax filing deadline is April 15th. However, if this date falls on a weekend or holiday, the deadline is shifted to the next business day.

- Estimated Tax Payments: Individuals and businesses with self-employment income or other income not subject to withholding are required to make quarterly estimated tax payments. The deadlines for these payments fall on the 15th day of the 4th, 6th, 9th, and 12th months of the tax year.

- Tax Extension Deadline: Taxpayers can request an extension to file their tax return, but not to pay taxes owed. This extension typically grants an additional six months to file, pushing the deadline to October 15th.

- IRS Audit Notifications: If the IRS selects a taxpayer for an audit, they will receive a formal notification detailing the reason for the audit and outlining the next steps.

Navigating the Calendar: Tips for Success

- Stay Organized: Maintaining meticulous records of income, expenses, and tax-related documents is crucial for accurate tax filing. Utilize digital tools, file folders, or other organizational methods to maintain an organized system.

- Plan Ahead: Proactively plan for tax obligations by setting aside funds for estimated tax payments and consulting with a tax professional to develop a personalized tax strategy.

- Seek Professional Guidance: Engaging a qualified tax professional can provide valuable insights and assistance with complex tax matters, ensuring accurate and compliant filing.

- Understand Your Tax Bracket: Familiarize yourself with your tax bracket and the applicable tax rates to accurately calculate tax liabilities.

- Utilize Available Resources: The IRS provides a wealth of resources, including online tools, publications, and phone support, to assist taxpayers in understanding their obligations and navigating the tax calendar.

The Importance of the Federal Tax Calendar

The federal tax calendar serves several vital purposes:

- Ensuring Compliance: The calendar provides a structured framework for taxpayers to meet their legal obligations and avoid penalties for late filing or non-payment.

- Fairness and Equity: By establishing consistent deadlines and requirements, the calendar ensures a level playing field for all taxpayers, promoting fairness and equity in the tax system.

- Financial Planning: The calendar encourages proactive financial planning, allowing individuals and businesses to budget for tax liabilities and maximize their financial outcomes.

- Revenue Generation: The calendar enables the government to collect revenue efficiently and effectively, funding essential public services and programs.

Frequently Asked Questions

Q: What are the penalties for late filing or non-payment of taxes?

A: Penalties for late filing and non-payment vary depending on the circumstances. Late filing penalties are typically calculated as a percentage of the unpaid tax liability, while late payment penalties may accrue interest and additional fees.

Q: Can I file my taxes electronically?

A: Yes, the IRS encourages electronic filing, which is generally faster, more accurate, and more secure than paper filing.

Q: What if I cannot afford to pay my taxes in full by the deadline?

A: The IRS offers various payment options, including payment plans, short-term extensions, and offers in compromise, to assist taxpayers facing financial hardship.

Q: How do I know if I am being audited by the IRS?

A: The IRS will send a formal notification letter outlining the reason for the audit and detailing the next steps.

Conclusion

Navigating the federal tax calendar is a critical component of responsible financial management. By understanding the key dates and deadlines, planning ahead, and seeking professional guidance when needed, individuals and businesses can ensure compliance with tax laws and optimize their financial outcomes. The federal tax calendar is not merely a collection of dates; it serves as a vital framework for maintaining a fair, efficient, and transparent tax system.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Federal Tax Calendar: A Comprehensive Guide for Individuals and Businesses. We thank you for taking the time to read this article. See you in our next article!