Navigating the 2025 Semi-Monthly Payroll Calendar: A Comprehensive Guide for Businesses

Related Articles: Navigating the 2025 Semi-Monthly Payroll Calendar: A Comprehensive Guide for Businesses

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the 2025 Semi-Monthly Payroll Calendar: A Comprehensive Guide for Businesses. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 2025 Semi-Monthly Payroll Calendar: A Comprehensive Guide for Businesses

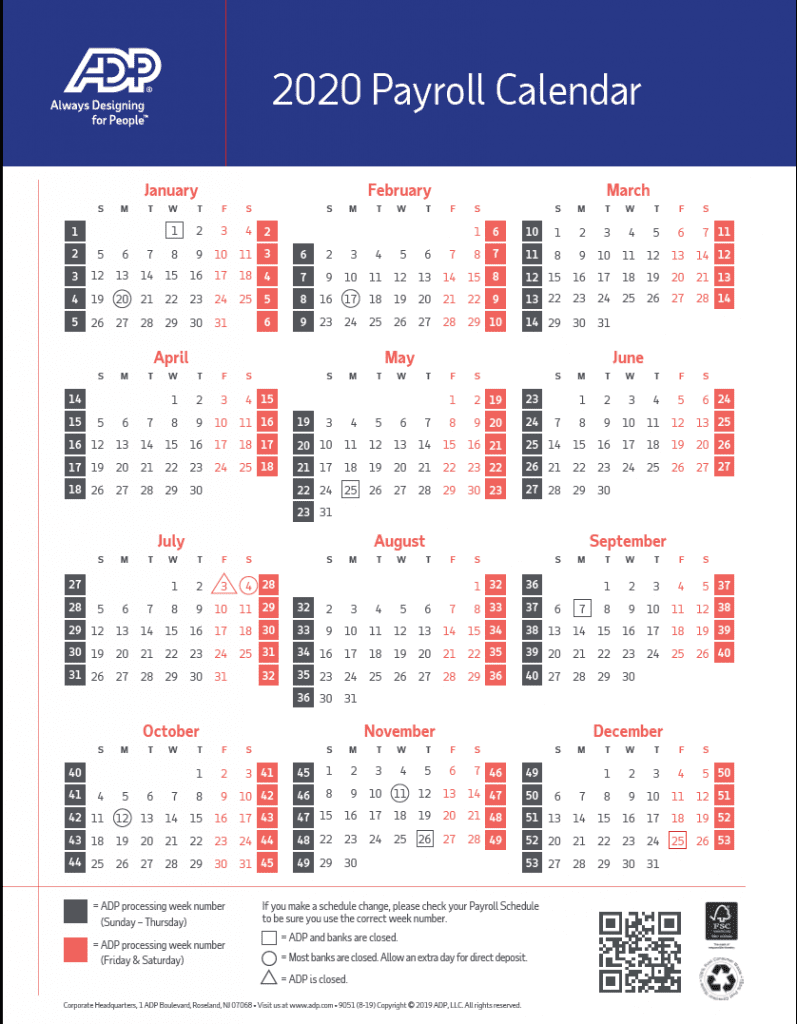

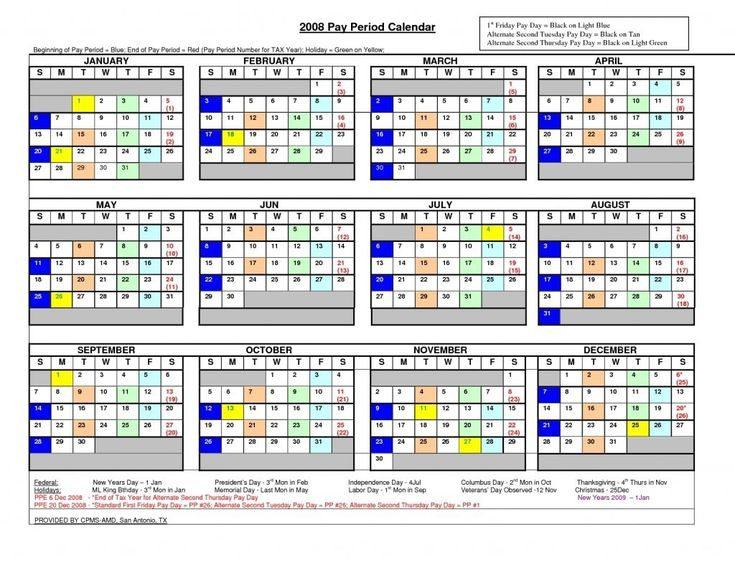

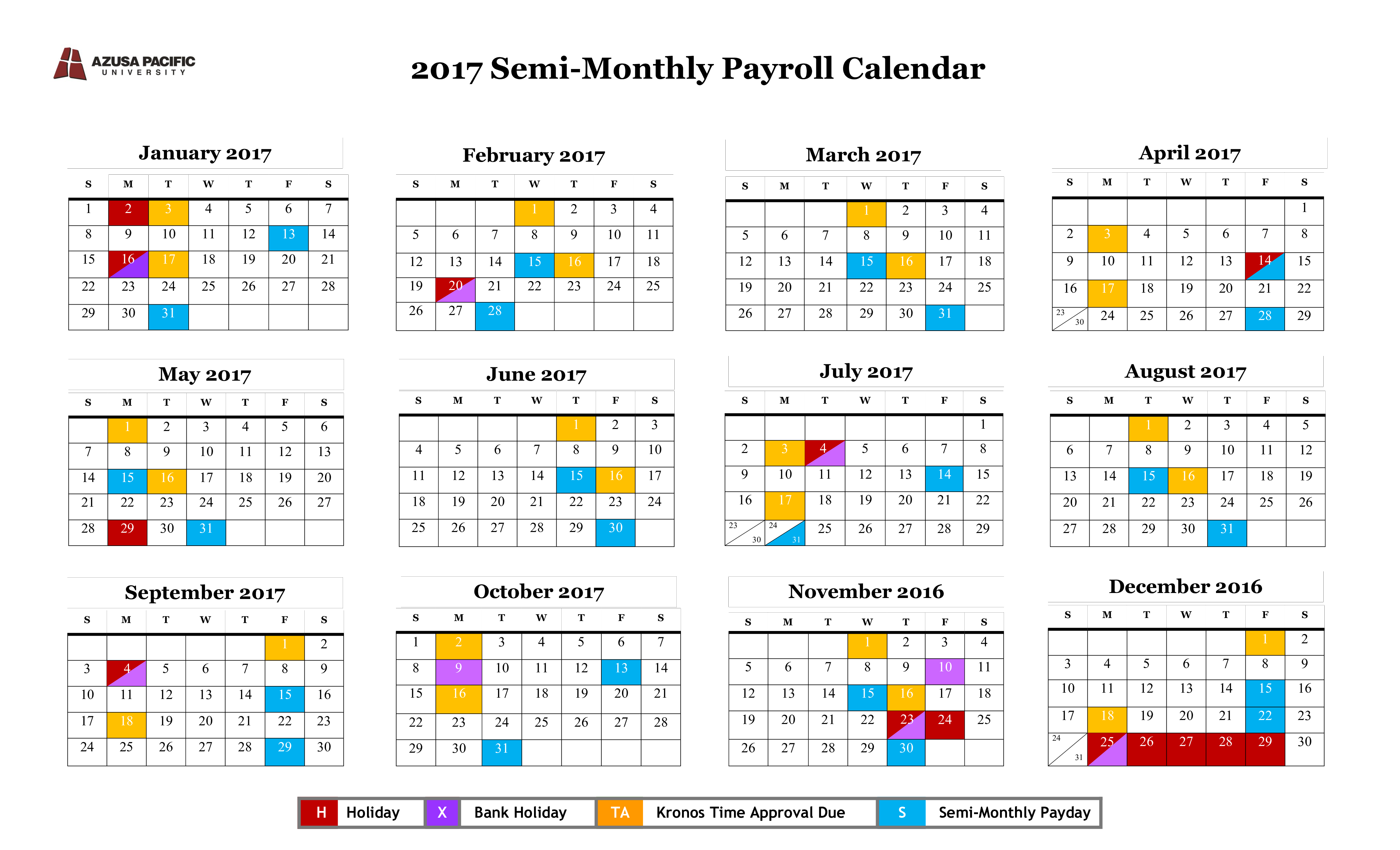

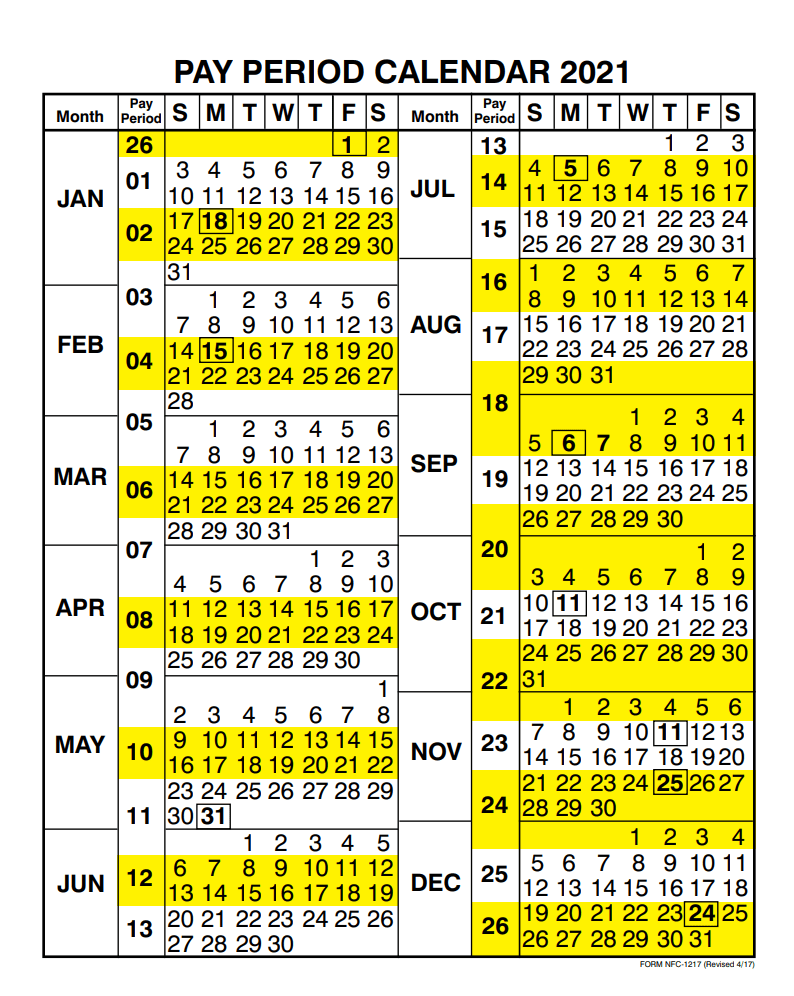

The 2025 semi-monthly payroll calendar serves as a crucial tool for businesses, ensuring timely and accurate payroll processing. This calendar outlines the specific dates on which payroll must be processed, offering a roadmap for efficient financial management. Understanding the intricacies of this calendar is essential for businesses to maintain compliance, avoid penalties, and foster positive employee relations.

Understanding the Semi-Monthly Payroll Cycle

Semi-monthly payroll, as the name suggests, involves paying employees twice a month. This contrasts with bi-weekly payroll, which involves paying employees every two weeks. The exact dates for semi-monthly payroll vary based on the specific calendar year and the chosen payroll schedule.

Key Components of the 2025 Semi-Monthly Payroll Calendar

The 2025 semi-monthly payroll calendar incorporates several key components:

- Payroll Dates: This calendar highlights the specific dates on which payroll must be processed. These dates are often set by the company or determined by legal requirements.

- Pay Periods: The calendar outlines the specific pay periods, typically covering 15 days each. This helps businesses track employee hours and earnings accurately.

- Holidays: The calendar considers federal and state holidays, adjusting payroll dates accordingly. This ensures employees are paid correctly even when holidays fall within a pay period.

- Weekends: The calendar accounts for weekends, ensuring payroll processing occurs on weekdays.

Benefits of Using a Semi-Monthly Payroll Calendar

Utilizing a semi-monthly payroll calendar offers numerous benefits for businesses:

- Improved Accuracy: A structured calendar minimizes errors in payroll calculations, ensuring employees receive accurate compensation.

- Enhanced Efficiency: By pre-planning payroll dates, businesses can streamline the process, saving time and resources.

- Compliance Assurance: Adhering to the calendar helps businesses comply with federal and state labor laws, avoiding potential penalties.

- Employee Satisfaction: Consistent and timely payroll payments contribute to employee satisfaction and morale.

- Financial Planning: The calendar allows businesses to budget effectively for payroll expenses, ensuring financial stability.

Navigating the 2025 Calendar: A Practical Guide

To effectively utilize the 2025 semi-monthly payroll calendar, businesses should consider the following:

- Choose a Consistent Schedule: Select a consistent payroll schedule, whether it’s the 1st and 15th or the 15th and the last day of the month.

- Communicate Clearly: Inform employees about the chosen payroll schedule and ensure they understand the pay dates.

- Integrate with Payroll Software: Leverage payroll software to automate calculations and streamline the process.

- Track Changes: Stay informed about potential changes to federal or state labor laws that might affect payroll dates.

- Review Regularly: Review the calendar periodically to ensure accuracy and make necessary adjustments.

FAQs: Addressing Common Questions

Q: What is the difference between semi-monthly and bi-weekly payroll?

A: Semi-monthly payroll involves paying employees twice a month, while bi-weekly payroll involves paying employees every two weeks. The frequency and specific dates of payments differ between the two methods.

Q: How do I determine the correct payroll dates for 2025?

A: The 2025 semi-monthly payroll calendar provides a comprehensive list of payroll dates. You can also consult with your payroll provider or a legal professional for guidance.

Q: What if a holiday falls within a pay period?

A: The 2025 calendar accounts for holidays, adjusting payroll dates accordingly. Ensure your payroll software is also updated to reflect these changes.

Q: Can I change my payroll schedule during the year?

A: While it’s possible to adjust your payroll schedule, it’s generally recommended to maintain consistency for employee clarity and financial planning. If changes are necessary, communicate them clearly to employees.

Tips for Effective Payroll Management

- Automate Payroll Processes: Leverage payroll software to automate calculations, reduce errors, and improve efficiency.

- Maintain Accurate Employee Records: Ensure employee information, including bank details and tax withholdings, is updated and accurate.

- Implement Strong Internal Controls: Establish clear procedures for payroll processing, including approvals and verification steps.

- Regularly Review Payroll Data: Monitor payroll expenses and identify potential discrepancies or inconsistencies.

- Stay Informed about Legal Updates: Keep abreast of any changes to federal or state labor laws that might impact payroll.

Conclusion

The 2025 semi-monthly payroll calendar serves as a vital tool for businesses to navigate the complexities of payroll processing. By understanding its key components and utilizing best practices, businesses can ensure timely and accurate payroll payments, fostering employee satisfaction and financial stability. This calendar empowers businesses to streamline operations, minimize errors, and maintain compliance with relevant regulations.

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2025 Semi-Monthly Payroll Calendar: A Comprehensive Guide for Businesses. We appreciate your attention to our article. See you in our next article!