Navigating the 2025 Options Market: A Guide to the CBOE Expiration Calendar

Related Articles: Navigating the 2025 Options Market: A Guide to the CBOE Expiration Calendar

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the 2025 Options Market: A Guide to the CBOE Expiration Calendar. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 2025 Options Market: A Guide to the CBOE Expiration Calendar

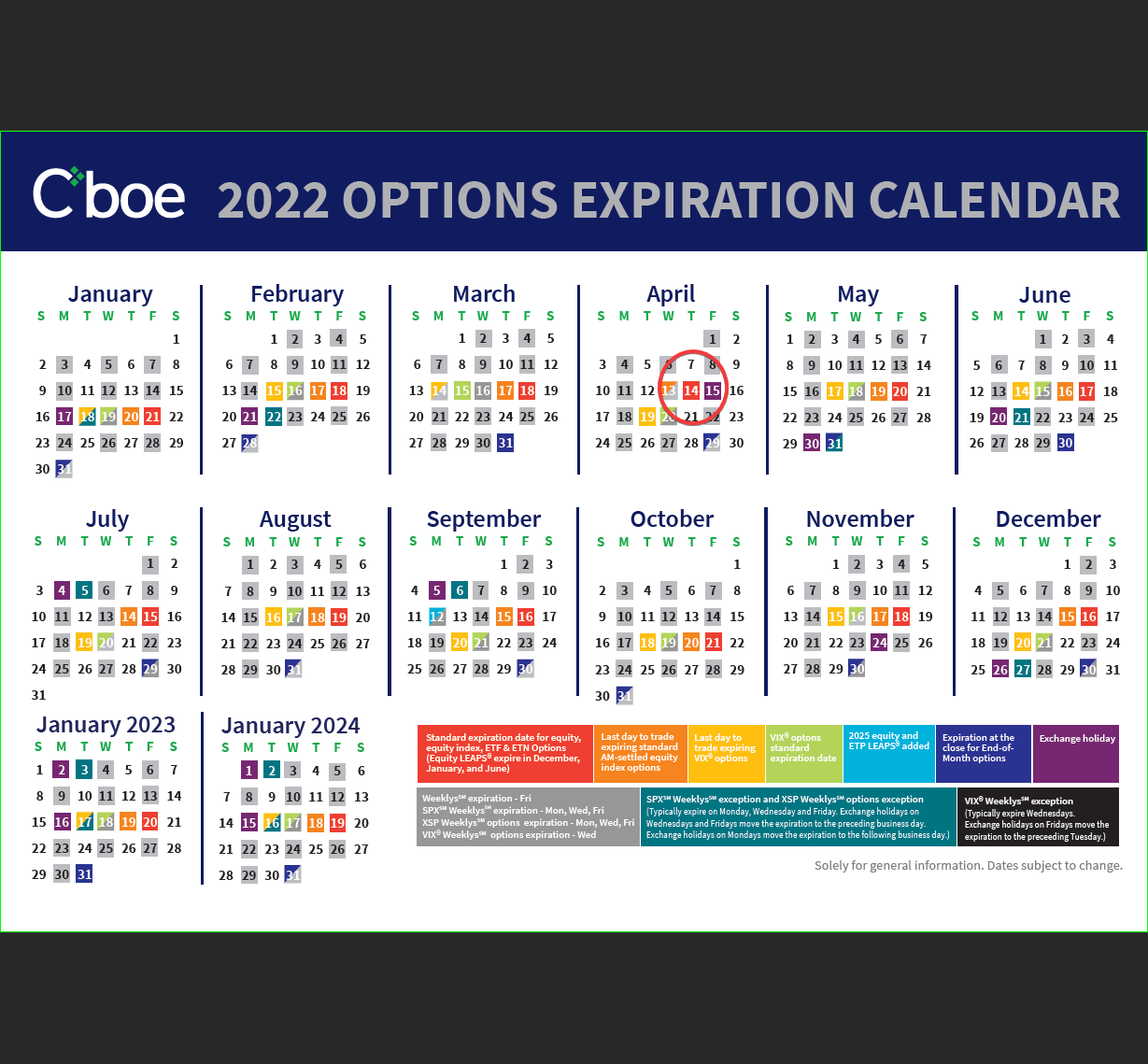

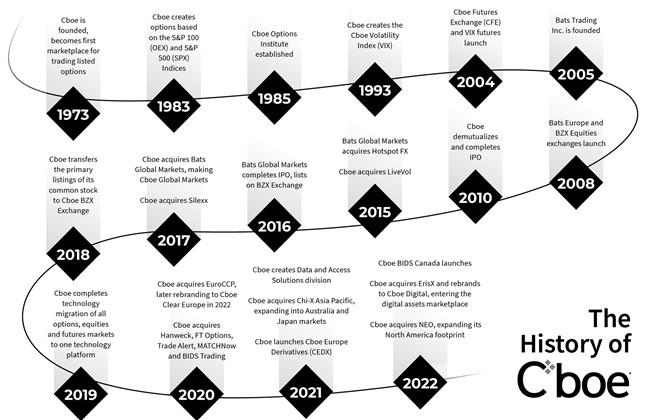

The CBOE (Chicago Board Options Exchange) is a leading platform for options trading, offering a wide range of contracts on various underlying assets, including stocks, indices, and exchange-traded funds (ETFs). Understanding the CBOE expiration calendar is crucial for options traders, as it provides a roadmap for managing positions, anticipating market volatility, and making informed trading decisions.

The CBOE Expiration Calendar: A Vital Resource for Options Traders

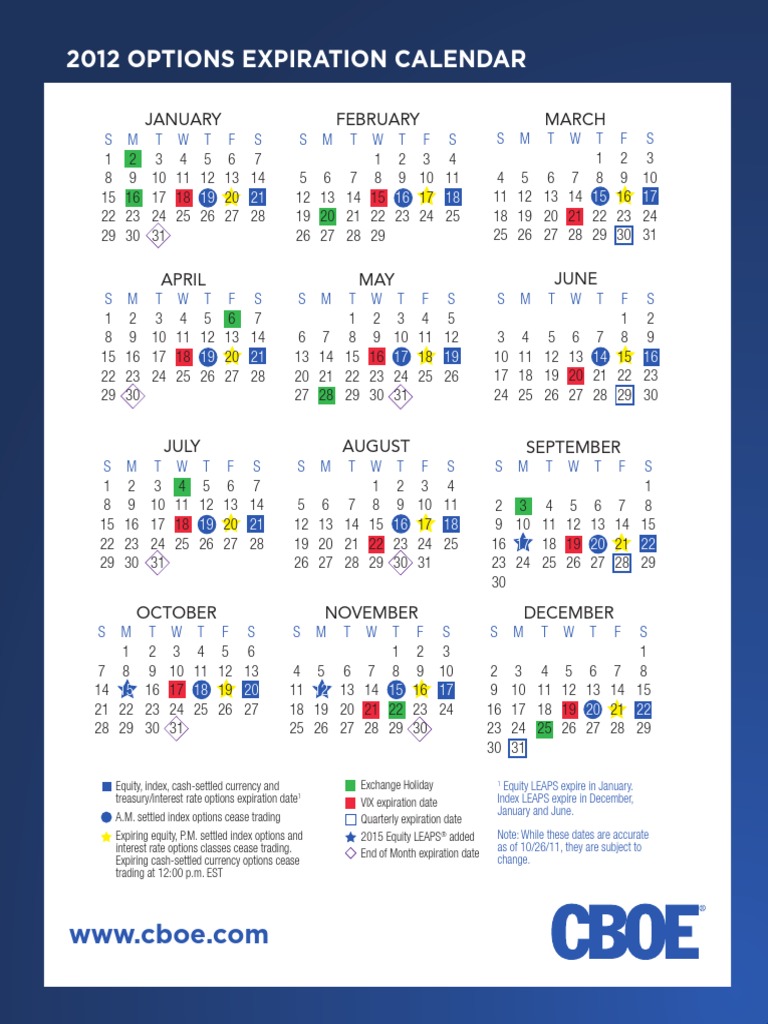

The CBOE expiration calendar outlines the specific dates on which options contracts expire for a given year. These dates are typically the third Friday of each month, with some exceptions. This calendar serves as a critical reference point for options traders for several reasons:

-

Managing Position Expiry: Options contracts have a limited lifespan, with a specific expiration date. The expiration calendar helps traders monitor their positions and ensure they are aware of upcoming expiration dates. This knowledge is crucial for making timely decisions regarding exercising, selling, or letting the options expire worthless.

-

Anticipating Market Volatility: Options contracts often exhibit increased volatility in the days and weeks leading up to their expiration. The calendar allows traders to anticipate these periods of heightened volatility and adjust their trading strategies accordingly.

-

Identifying Potential Trading Opportunities: The expiration calendar can be a valuable tool for identifying potential trading opportunities. By analyzing historical data and anticipating upcoming expirations, traders can identify specific options contracts that may be particularly volatile or present attractive risk-reward profiles.

Understanding the 2025 CBOE Expiration Calendar

The 2025 CBOE expiration calendar follows the standard pattern of the third Friday of each month, with a few notable exceptions:

- January 2025: The third Friday falls on January 17th.

- February 2025: The third Friday falls on February 21st.

- March 2025: The third Friday falls on March 21st.

- April 2025: The third Friday falls on April 18th.

- May 2025: The third Friday falls on May 16th.

- June 2025: The third Friday falls on June 20th.

- July 2025: The third Friday falls on July 18th.

- August 2025: The third Friday falls on August 15th.

- September 2025: The third Friday falls on September 19th.

- October 2025: The third Friday falls on October 17th.

- November 2025: The third Friday falls on November 21st.

- December 2025: The third Friday falls on December 19th.

Beyond the Standard Expiration Dates:

While the third Friday of the month is the general rule, there are instances where options contracts expire on other dates:

-

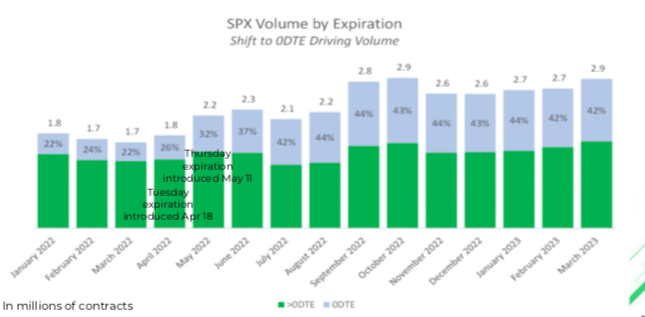

Weekly Options: Some options contracts, particularly those on popular indices like the S&P 500, expire weekly. These weekly options provide traders with greater flexibility and the ability to capitalize on shorter-term market movements.

-

Special Expirations: Occasionally, the CBOE may announce special expirations for specific options contracts, often tied to significant market events or holidays.

Utilizing the CBOE Expiration Calendar for Effective Trading

Traders can leverage the CBOE expiration calendar in several ways to enhance their options trading strategies:

-

Position Management: By tracking upcoming expirations, traders can proactively manage their positions and make informed decisions regarding exercise, selling, or letting options expire.

-

Volatility Management: The calendar helps traders anticipate periods of heightened volatility and adjust their trading strategies accordingly. This could involve reducing exposure, employing hedging strategies, or capitalizing on the increased volatility.

-

Identifying Trading Opportunities: The calendar can be used to identify specific options contracts that may be particularly volatile or present attractive risk-reward profiles, based on historical data and anticipated market movements.

FAQs About the CBOE Expiration Calendar

Q: Where can I find the CBOE expiration calendar?

A: The CBOE expiration calendar is readily available on the CBOE website. It can also be found on many financial websites and trading platforms.

Q: What happens when an options contract expires?

A: When an options contract expires, the holder of the contract has three options:

- Exercise: The holder can exercise the option and buy or sell the underlying asset at the strike price.

- Sell: The holder can sell the option contract in the market before expiration.

- Let it expire: The holder can let the option expire worthless.

Q: How do I know which options contracts have weekly expirations?

A: The CBOE website provides a dedicated section for weekly options, which lists all the contracts with weekly expirations.

Q: Are there any exceptions to the standard expiration dates?

A: Yes, there are exceptions. Some options contracts, particularly those on popular indices, may expire weekly. Additionally, the CBOE may announce special expirations for specific options contracts, often tied to significant market events or holidays.

Tips for Utilizing the CBOE Expiration Calendar

- Stay informed: Regularly check the CBOE expiration calendar to stay up-to-date on upcoming expiration dates.

- Plan ahead: Factor in expiration dates when planning your options trading strategies.

- Manage risk: Be aware of the increased volatility associated with options contracts approaching expiration and adjust your trading strategies accordingly.

- Seek guidance: If you are new to options trading, consult with a financial advisor or experienced trader for guidance on navigating the expiration calendar and managing options positions.

Conclusion

The CBOE expiration calendar is an essential tool for options traders. By understanding the calendar and its implications, traders can make informed decisions regarding position management, volatility mitigation, and identifying potential trading opportunities. The calendar provides a roadmap for navigating the complex world of options trading, empowering traders to make more informed and profitable decisions.

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2025 Options Market: A Guide to the CBOE Expiration Calendar. We thank you for taking the time to read this article. See you in our next article!