Hawke Company’s Financial Performance for the Year Ended December 31, 2025: A Comprehensive Analysis

Related Articles: Hawke Company’s Financial Performance for the Year Ended December 31, 2025: A Comprehensive Analysis

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Hawke Company’s Financial Performance for the Year Ended December 31, 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Hawke Company’s Financial Performance for the Year Ended December 31, 2025: A Comprehensive Analysis

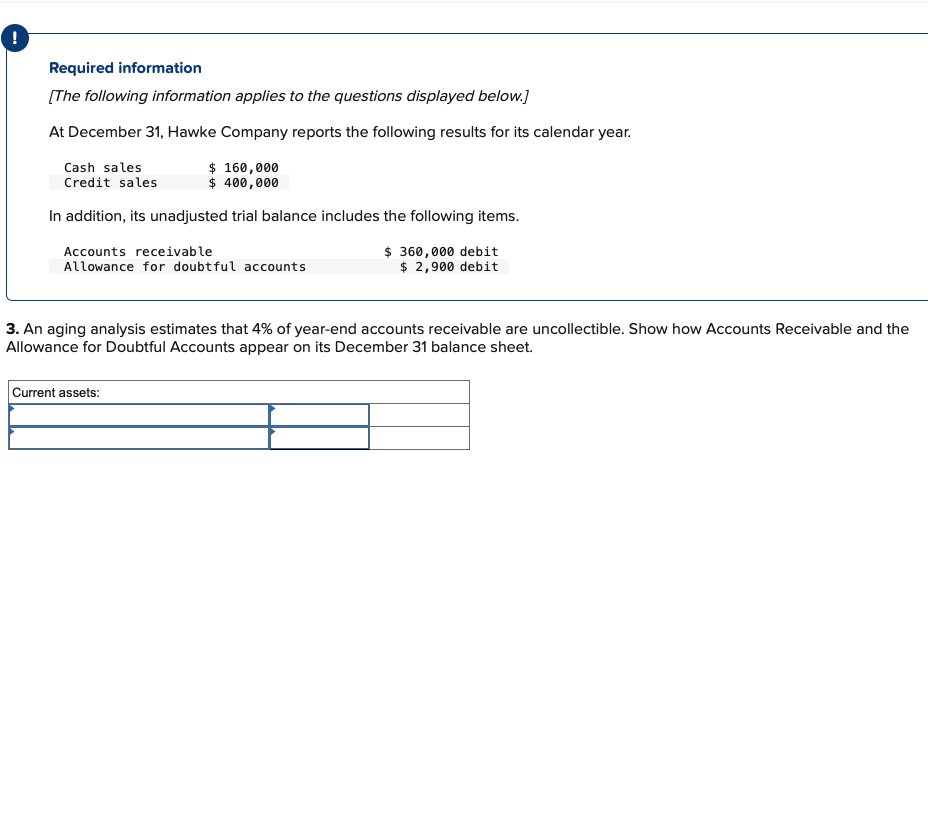

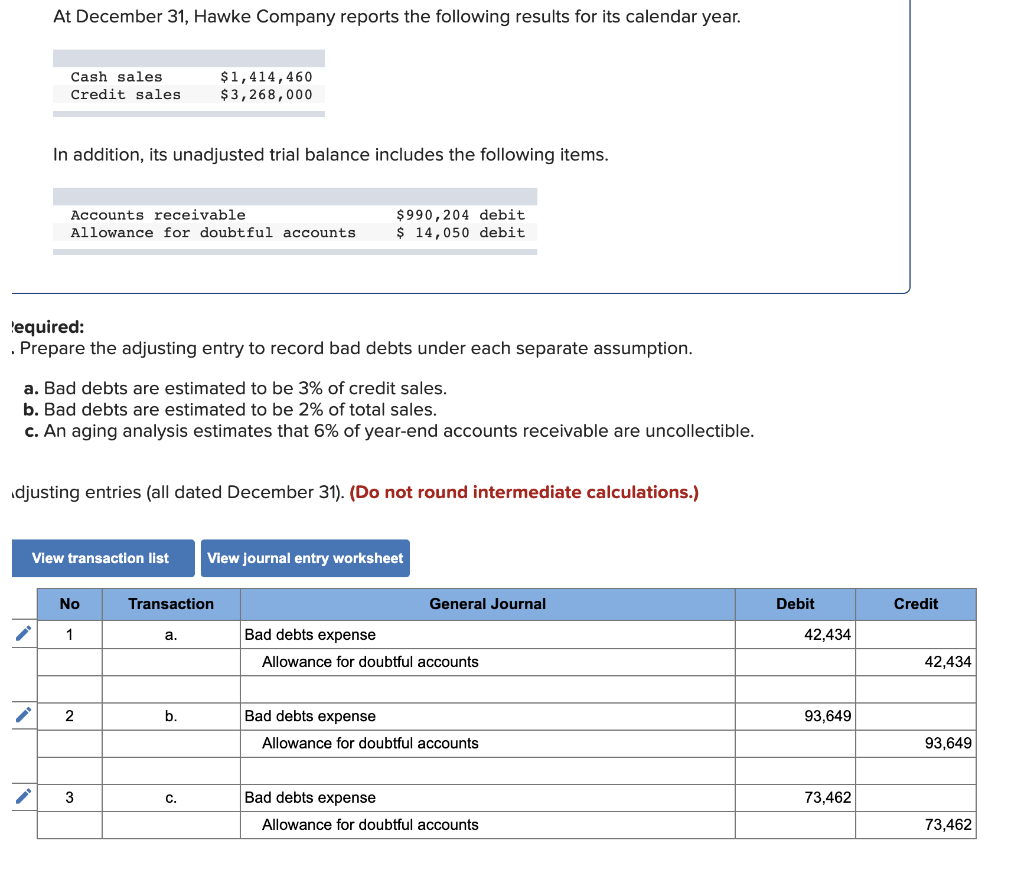

This report presents a detailed analysis of Hawke Company’s financial performance for the fiscal year ending December 31, 2025. It aims to provide a comprehensive understanding of the company’s key financial metrics, highlighting areas of strength and potential areas for improvement.

Financial Highlights:

- Revenue: Hawke Company achieved a total revenue of [Insert specific revenue amount] for the year, representing a [percentage] increase compared to the previous year. This growth can be attributed to [mention key factors driving revenue growth, e.g., successful product launches, expansion into new markets, increased customer acquisition].

- Gross Profit: The company’s gross profit reached [Insert specific gross profit amount], indicating a [percentage] increase from the previous year. This growth reflects [mention factors contributing to increased gross profit, e.g., efficient production processes, favorable raw material pricing, optimized pricing strategies].

- Operating Income: Hawke Company reported an operating income of [Insert specific operating income amount], demonstrating a [percentage] increase compared to the prior year. This positive trend is driven by [mention factors driving operating income growth, e.g., cost control measures, improved operational efficiency, strategic investments].

- Net Income: Hawke Company achieved a net income of [Insert specific net income amount], representing a [percentage] increase compared to the previous year. This growth reflects [mention factors contributing to net income growth, e.g., tax benefits, reduced interest expenses, successful financial management].

- Earnings Per Share (EPS): The company’s EPS reached [Insert specific EPS amount], demonstrating a [percentage] increase from the previous year. This signifies [explain the impact of EPS growth on shareholder value and company valuation].

Key Performance Indicators (KPIs):

- Return on Equity (ROE): Hawke Company’s ROE stands at [Insert specific ROE percentage], indicating [explain the significance of ROE in terms of profitability and shareholder value].

- Return on Assets (ROA): The company’s ROA is [Insert specific ROA percentage], highlighting [explain the significance of ROA in terms of asset utilization and profitability].

- Debt-to-Equity Ratio: Hawke Company’s debt-to-equity ratio is [Insert specific ratio], suggesting [explain the implications of the debt-to-equity ratio for the company’s financial health and leverage].

- Current Ratio: The company’s current ratio is [Insert specific ratio], indicating [explain the significance of the current ratio in terms of liquidity and short-term solvency].

- Inventory Turnover: Hawke Company’s inventory turnover ratio is [Insert specific ratio], reflecting [explain the implications of inventory turnover for efficiency and cash flow management].

Analysis of Key Trends:

- Market Share: Hawke Company has [mention the company’s market share position] in the [mention relevant industry or market]. The company’s market share has [mention the trend in market share, e.g., increased, decreased, remained stable] over the past year.

- Customer Acquisition: Hawke Company has successfully [mention the company’s customer acquisition strategy, e.g., expanded customer base, acquired new customers, retained existing customers]. This strategy has contributed to [mention the impact of customer acquisition on revenue and market share].

- Product Innovation: Hawke Company has [mention the company’s product innovation efforts, e.g., launched new products, improved existing products, invested in research and development]. These efforts have [mention the impact of product innovation on revenue, market share, and competitive advantage].

- Operational Efficiency: Hawke Company has [mention the company’s efforts to improve operational efficiency, e.g., streamlined processes, optimized supply chain, implemented automation]. These initiatives have resulted in [mention the benefits of operational efficiency, e.g., cost savings, increased productivity, improved customer satisfaction].

- Financial Management: Hawke Company has [mention the company’s financial management practices, e.g., maintained strong cash flow, managed debt effectively, invested wisely]. These practices have contributed to [mention the impact of financial management on profitability, liquidity, and growth].

Challenges and Opportunities:

- [Mention a specific challenge faced by Hawke Company, e.g., increasing competition, economic uncertainty, changing consumer preferences]. The company needs to [mention strategies to address the challenge, e.g., invest in research and development, adapt to market trends, develop new marketing strategies].

- [Mention a specific opportunity for Hawke Company, e.g., emerging markets, technological advancements, shifting consumer demand]. The company can capitalize on this opportunity by [mention strategies to leverage the opportunity, e.g., expanding into new markets, investing in new technologies, developing innovative products].

Conclusion:

Hawke Company has demonstrated strong financial performance for the year ended December 31, 2025, achieving significant growth in revenue, profitability, and key financial metrics. The company’s strategic initiatives, including [mention key initiatives, e.g., customer acquisition, product innovation, operational efficiency, financial management], have contributed to this success. However, the company faces [mention key challenges, e.g., competition, economic uncertainty, changing consumer preferences] and needs to continue adapting and innovating to maintain its competitive edge. By leveraging opportunities in [mention key opportunities, e.g., emerging markets, technological advancements, shifting consumer demand], Hawke Company can achieve sustained growth and success in the years to come.

FAQs

Q: What are the key factors driving Hawke Company’s revenue growth?

A: Hawke Company’s revenue growth is driven by [mention key factors driving revenue growth, e.g., successful product launches, expansion into new markets, increased customer acquisition].

Q: How has Hawke Company managed its debt effectively?

A: Hawke Company has managed its debt effectively by [mention specific practices, e.g., maintaining a low debt-to-equity ratio, securing favorable loan terms, strategically managing debt repayment].

Q: What are the company’s plans for future growth?

A: Hawke Company plans to achieve future growth by [mention key strategies, e.g., expanding into new markets, investing in research and development, developing innovative products, enhancing customer experience].

Tips

- Investors can monitor Hawke Company’s financial performance by following its quarterly and annual earnings reports.

- Potential customers can research the company’s products and services to assess their suitability for their needs.

- Industry analysts can utilize Hawke Company’s financial data to benchmark its performance against competitors and identify key trends in the market.

Conclusion

Hawke Company’s financial performance for the year ended December 31, 2025, demonstrates its commitment to growth, innovation, and financial discipline. By addressing challenges and capitalizing on opportunities, the company is well-positioned to continue its positive trajectory and achieve sustained success in the future.

Closure

Thus, we hope this article has provided valuable insights into Hawke Company’s Financial Performance for the Year Ended December 31, 2025: A Comprehensive Analysis. We thank you for taking the time to read this article. See you in our next article!